Caught in a trap! Taylor Wimpey “sorry” for ripping off leaseholders!

Some mistakes are hard to fix. It is better to be careful – not sorry!

Taylor Wimpey used a trading statement last week to announce their ‘conclusions’ following a review into the company’s historic lease structures. This focused solely on a specific lease structure used from 2007 to late 2011, which provides that the ground rent doubles every 10 years until the 50th year. In doing so, the company created a new asset class that is now very attractive to specialist investors, because it equates to an annual interest rate of 7%. Taylor Wimpey claimed these leases “are considered to be entirely legal.” It remains to be seen whether the charges would be deemed by a court to be ‘fair and reasonable’ Under the Unfair Terms in Consumer Contracts Regulations 1999.

Taylor Wimpey now admit that: “the introduction of these doubling clauses was not consistent with our high standards of customer service and we are sorry for the unintended financial consequence and concern that they are causing.” Surprisingly, Taylor Wimpey says the total cash outflow of around £130million “will be spread over a number of years.” In addition, this only applies to the “qualifying customers subject to eligibility checks” – only those owners who bought from Taylor Wimpey are to be “helped.”

Taylor Wimpey now admit that: “the introduction of these doubling clauses was not consistent with our high standards of customer service and we are sorry for the unintended financial consequence and concern that they are causing.” Surprisingly, Taylor Wimpey says the total cash outflow of around £130million “will be spread over a number of years.” In addition, this only applies to the “qualifying customers subject to eligibility checks” – only those owners who bought from Taylor Wimpey are to be “helped.”

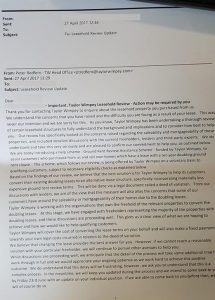

Ground Rent Review

Taylor Wimpey has written to buyers who have complained about their leases with the onerous ground rent doubling clause. In the letter Taylor Wimpey outline its “Ground Rent Review Assistance Scheme” funded by the company, which offers to negotiate on the customers’ behalf with freehold owners for a ‘Deed of Variation’ to “convert existing doubling leases to an alternative lease structure incorporating materially less expensive ground rent review terms.” with Taylor Wimpey covering the financial cost of doing so”.

Taylor Wimpey has written to buyers who have complained about their leases with the onerous ground rent doubling clause. In the letter Taylor Wimpey outline its “Ground Rent Review Assistance Scheme” funded by the company, which offers to negotiate on the customers’ behalf with freehold owners for a ‘Deed of Variation’ to “convert existing doubling leases to an alternative lease structure incorporating materially less expensive ground rent review terms.” with Taylor Wimpey covering the financial cost of doing so”.