The Stamp Duty reform announcement in George Osborne’s Autumn Statement is yet another example of UK Government’s generosity towards the house building industry. It could be argued that anyone buying a home, old or new-build will benefit, with reportedly 98% of homebuyers paying less from today. However the reform, whilst long overdue, will mean more people paying higher stamp duty in the long run with the housing market no longer constrained at the old price threshold levels and sellers free to tick up asking prices above the £125,000 zero threshold.

The Stamp Duty reform announcement in George Osborne’s Autumn Statement is yet another example of UK Government’s generosity towards the house building industry. It could be argued that anyone buying a home, old or new-build will benefit, with reportedly 98% of homebuyers paying less from today. However the reform, whilst long overdue, will mean more people paying higher stamp duty in the long run with the housing market no longer constrained at the old price threshold levels and sellers free to tick up asking prices above the £125,000 zero threshold.

Many experts say the surprise change to the stamp duty system is likely to provide a fresh boost to the housing market and lead to higher prices for homes where the tax will be cut, property experts have warned. Mortgage lenders and estate agents have argued for a long time that this distorts the market, with house prices bunched just below thresholds.

Many experts say the surprise change to the stamp duty system is likely to provide a fresh boost to the housing market and lead to higher prices for homes where the tax will be cut, property experts have warned. Mortgage lenders and estate agents have argued for a long time that this distorts the market, with house prices bunched just below thresholds.

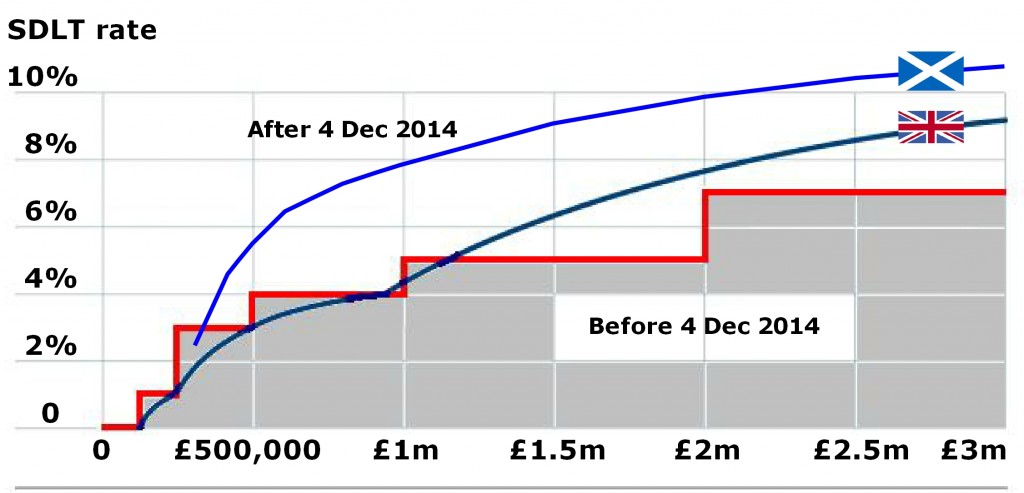

The good news is that the stamp duty tax will no longer be charged at the threshold percentage on the total asking price, but will be tiered in the same way as income tax is. If anyone is in any doubt that buyers will be paying more stamp duty in the future, you only have to look at how many ordinary workers, earning modest salaries, are currently being snared by the 40% tax threshold, as successive governments failed to increased thresholds in line with either salaries or inflation.

According to the treasury, everyone buying a house for less than £925,000 (98% of buyers) will be better off under the new system. In 2013-14 the Treasury took £6.45bn from Stamp Duty tax, an increase of 74% on the 2003-04 figure, even though there were fewer transactions. Sales in London accounted for nearly 42% of the stamp duty raised.

The “slab structure” was scrapped and from midnight and Stamp Duty tax will be applied with the higher rates only applied to the portion above each threshold like income tax. New Stamp Duty Calculator

From today, there will still be no tax on property purchases up to £125,000. Above that there will be several bands:

- For the amount between £125,001 and £250,000 the rate will be 2%

- For the amount between £250,001 and £925,000 the rate will be 5%

- For the amount between £925,001 and £1.5m the rate will be 10%

- Above £1.5m the rate will be 12%.

For example on a £200,000 house purchase there will be no tax to pay on the first £125,000, then 2% on the remaining £75,000, which is a total bill of £1,500, versus £2,000 before the changes – a saving of £500.

On a £300,000 house purchase there would be no tax to pay on the first £125,000, then 2% on the next £125,000 (£2,500) and 5% on the remaining £50,000 (£2,500). That’s a total £5,000 compared with £9,000 under the old system – a saving of £4,000.

It comes to something when the UK government takes its lead from a Scottish Parliament that has only had new powers for a matter of weeks. So how does this compare with the stamp duty changes in Scotland? The lowest rate of tax starts £10,000 earlier, but after that the tax take in Scotland is double that of the rest of the UK for homes sold for under £925,000.