House builders’ new Code of Practice

The New Homes Quality Board [NHQB] “championing quality new homes and Better consumer outcomes” “Code of Practice” – “New Homes Quality Code” – “House Building Consumer Code”- “The Code” call it what you like, but is it has the potential to be pretty much as useless as the Consumer Code for Homebuilders [CCHB] it replaces, unless it is properly and independently enforced.

The New Homes Quality Board [NHQB] “championing quality new homes and Better consumer outcomes” “Code of Practice” – “New Homes Quality Code” – “House Building Consumer Code”- “The Code” call it what you like, but is it has the potential to be pretty much as useless as the Consumer Code for Homebuilders [CCHB] it replaces, unless it is properly and independently enforced.

Will the onus be on the new homebuyer to prove (or have physical evidence) that Code requirements were breached, as was the case with the old and ineffective, CCHB, or will house builders now be required to show physical evidence to prove they complied with Code requirements?

An industry Code of Practice was originally recommended following an Inquiry by the APPG EBE with their report, “Better Redress for Homebuyers” published in June 2018. Report recommendation (5) states: “Industry-wide code of practice: We are recommending that government, warranty providers, housebuilders and consumer groups work together to draw up a code of practice which would be used by the New Homes Ombudsman to adjudicate on disputes.”

Subsequently, the Government consultation ‘Redress for purchasers of New Build Homes and the New Homes Ombudsman‘ finally published – 102 days later than the 84-day target – on 24 February 2020, again championed the suggestion of an industry-created Code of Practice and eventually this new house builders’ Code of Practice was created by the NHQB.

As I said in a previous blog article at the time, Redress? When will New Homes Ombudsman be operational? any industry collaborated/created Code of Practice will invariably be used to limit or restrict the redress available to new homebuyers and the effectiveness and powers of the New Homes Ombudsman (as has been the case with the industry’s own CCHB).

This must not be permitted.

The New Homes Ombudsman whether voluntary or eventually statutory, must not be confined to decisions arising only from a breach of requirements of the Code of Practice and every complaint should be judged on its own individual circumstances and merits.

The New Homes Quality Board finally published its new “Code of Practice” for house builders and developers on 16 December 2021. Having taken the time to digest its expansive 30 pages (8,752 words) and a further 17 pages of “Developer Guidance” it would appear to be much more detailed and far less ambiguous as the Consumer Code for Homebuilders (CCHB) (11 pages 3,034 words) it replaces.

The New Homes Quality Board finally published its new “Code of Practice” for house builders and developers on 16 December 2021. Having taken the time to digest its expansive 30 pages (8,752 words) and a further 17 pages of “Developer Guidance” it would appear to be much more detailed and far less ambiguous as the Consumer Code for Homebuilders (CCHB) (11 pages 3,034 words) it replaces.

Whilst most of the old CCHB has been ‘cut and pasted’ to the new Code there are significant new requirements which should go some way to redressing the balance towards the new homebuyer and force errant plc housebuilders to finally smell to coffee and mend their scandalous treatment of their own customers.

Statement of Fundamental Principals

The new Code sets out a clear and unambiguous “Statement of Principals (the Fundamental Principles); fundamental and overriding obligations which Registered house builders and developers agree to follow when building and selling customers a new home.

- Fairness: treat Customers fairly throughout the home buying and AfterSales process.

This is probably the most useful, as any detraction will be a fundamental breach. - Safety: carry out and complete works in accordance with all requisite Building Regulations and Requirements.

Any breach of building regulations will be a breach of Code requirement(s) - Quality: complete all works to a good quality in accordance with all applicable building and other standards and regulations as well as to the specification for the New Home and ensure that Legal Completion only takes place when a New Home is complete.

A “complete new home” being defined as one which has a warranty cover note issued and where the new home complies with building regulations. But the home can have solely decorative/corrective works outstanding and temporary services connected, which could be via a generator for example! So plenty of builder wiggle room there! - Service: have in place systems, processes and training of staff to meet the Customer service Requirements of the New Homes Quality Code and not use high-pressure selling techniques to influence a Customer’s decision to buy a New Home.

Just how will this be proved by the homebuyer, measured and enforced? - Responsiveness: be clear, responsive and timely in responding to Customer issues by having in place a robust AfterSales Service and effective Complaints process as required by the Code.

No definition of what will be deemed “robust” or “effective2 but failure to meet required Code timescales should be considered a breach. - Transparency: provide clear and accurate information about the purchase of the New Home, including tenure and potential future committed costs such as those relating to Leasehold or Management Services.

Saying isn’t doing. This is already enshrined in UK Law and the industry’s historic failure (leasehold and fleecehold scandals) demonstrates that ‘requiring’ without proper enforcement and sanctions for those found to be breaching Code requirements is unlikely to ensure compliance. - Independence: make sure that Customers are aware that they should appoint independent legal advisers when buying a New Home and that they have the right, as set out in the Code, to an independent Pre-Completion Inspection before Legal Completion takes place.

The biggest step forward. But as examined below, the pre inspection right has strings attached to limit thorough and effective inspections. - Inclusivity: take steps to identify and provide appropriate support to Vulnerable Customers as well as to make the Code available to all Customers, including in appropriately accessible formats and languages.

Biggest benefit will be for those considering buying a retirement flat/property, which has a long history of excessive fees, event fees and covenants. - Security: ensure that there are reasonable financial arrangements in place, through insurance or otherwise, to meet all obligations under the Code, including timely repayment of financial deposits when due and any financial awards made by a New Homes Ombudsman Service.

- Compliance: be subject to, co-operate and comply with the Requirements of the New Homes Quality Board and a New Homes Ombudsman Service.

Pre Completion inspection Requirement 2.8 & 2.11 (C)

The stand out requirement is the right for new homebuyers – or their “suitably qualified inspector” – to a pre-legal completion inspection. The pre-completion inspection must be carried out from five calendar days after the notice to complete has been served and before legal completion. But this has plc house builder’s paw prints all over it. For example th inspection can only be carried out using the NHQB “Template Pre-Legal Completion Checklist” -yet to be made public! For more comment on this key Code requirement and its current shortcomings click Pre-Legal Completion Inspection.

Legal and other professional advisors

For the first time, it is a requirement (1.7) that the house builder disclose any fees or commission they receive at the time of reservation, referral, or purchase for introducing any professional advisor such as solicitor or mortgage brokers.

As previously with the CCHB (Req 2.5) the house builder is forbidden to restrict the homebuyer’s choice of legal representative to any solicitor or any one from a list recommended by the builder. In addition, the house builder can no longer limit any incentive or inducement when recommending any such services, which was previously permitted by the old CCHB (Requirement 2.5). Even despite the old CCHB requirement 2.5, restricting homebuyer’s choice of solicitor to one the builder required was a common practice. Perhaps now the new crystal clear Code requirements and the law will be properly enforced.

Provide all relevant information.

More precisely, this should be all information. However, added to the expanded list over and above the old CCHB is a requirement to including tenure, management charges, estate charges and event fees etc. Information should also include details of services facilities which transfer to the buyer at a later date such as utilities, restrictions on provision of services and service providers; drainage, non-adopted roads and public open spaces. (Fleecehold) Details of the new home should now include any “significant” gradients to the garden and grounds of the new home. Clearly previous complaints under the CCHB have been considered.

Other requirements

New requirements for part-exchange, assisted moving schemes and early-bird arrangements.

Another new requirement (2.3) is a 14-day cooling off period, during which the new homebuyer can cancel their reservation for any reason and receive a full refund of any fees.

For the first time a house builder Code with requirements for fixing defects and snags

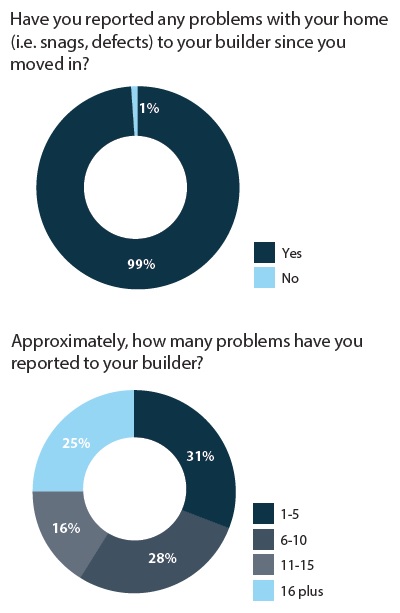

It is a requirement that house builders must ensure that snags and defects reported to them are dealt with promptly, within a maximum of 30 calendar days, other than where there is an exceptional reason for delay. The new Code of Practice (3.4) sets out time-scales for each of the required written house builder responses, following receipt of a new homebuyer’s complaint. If any of the issues in the complaint are not resolved within the timetables or procedures (56 days after the initial complaint) then new homebuyer can refer a dispute to the New Homes Ombudsman Service.

As with everything plc house builders create, it could well be 2023 before any of this actually comes into being. House builders and developers are able to register with the NHQB from 31 January 2022 to the end of 2022.

As with everything plc house builders create, it could well be 2023 before any of this actually comes into being. House builders and developers are able to register with the NHQB from 31 January 2022 to the end of 2022.

The cynic in me believes that it is likely that most plc housebuilders will leave “registering” until after their year-end or half-year figures (30 June) meaning buyers will not be able to use the New Homes Ombudsman Service or have the right inspect their homes before legal completion. Indeed, many house builders may even delay registering until late December 2022.

Anyone buying a new home this year, should ask if the house builder is registered with NHQB as they will not be able to access the New Homes Ombudsman Service if the builder is not registered at the time they reserve (or legally complete) on their home “whichever is the later”.

The New Homes Ombudsman Service is due to be in operation in “early 2022” details of the scheme are yet to be made public. After my 8-year long campaign I am watching and waiting!

UPDATE: On 8th March 2022, the NHQB has confirmed to me:

“In terms of builder registration, we have started with a soft launch by invitation only, in order to test that our systems and processes are working as expected. So far we have invited 14 builders and had responses from 10. Of those, 8 have completed the application process and are now in the transition period, completing their training and other readiness preparations before going live.

We expect to send the next tranche of invitations out in the next couple of weeks, and envisage the system being fully opened for all applications during May.”