Ed Milband announced this week, that if Labour triumph in next weeks’ election, he will abolish stamp duty for three years to help first time buyers buying homes costing up to £300,000. At this level, the maximum saving in stamp duty land tax will be £5,000. It is being claimed that 90% of first time buyers will benefit.

Ed Milband announced this week, that if Labour triumph in next weeks’ election, he will abolish stamp duty for three years to help first time buyers buying homes costing up to £300,000. At this level, the maximum saving in stamp duty land tax will be £5,000. It is being claimed that 90% of first time buyers will benefit.

But you read it here first!

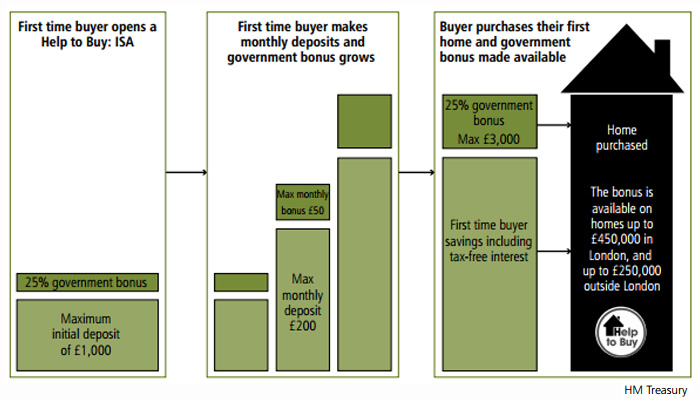

On 20 March after the Conservatives announced their Help to Buy ISA in the Budget speech, I suggested it would be fairer, easier to implement and more help right now, to abolish stamp duty on all first time buyer homes up to £260,000. I also called for an end to the lucrative tax breaks enjoyed by Buy to Let landlords such as ending tax relief on mortgage interest to facilitate a flood of properties to the market, the very properties usually bought by first-timers.

Whilst welcome, and a much better and effective measure than the Conservatives’ own election bribe for first time buyers – the ill-thought out Help to Buy ISA (Bisa), it will also not make homes more affordable. When stamp duty was abolished in March 210 on homes up to £250,000, treasury analysts discovered that it actually facilitated a 0.7% increase in house prices.

In his speech in Stockton on Monday, Mr Miliband said: “There’s nothing more British than the dream of home-ownership, starting out in a place of your own. But for so many young people today that dream is fading with more people than ever renting when they want to buy, new properties being snapped up before local people get a look-in, young families wondering if this country will ever work for them. That is the condition of Britain today, a modern housing crisis which only a Labour government will tackle.”