Just when I think there isn’t anything else this industry can shock me with – coverage in the national press has revealed that Bovis Homes offered “bribes” of up to £3,000 to their buyers if they legally completed or moved into unfinished new homes on or before 23rd December 2016. This was done in a vain attempt to meet the City forecasted target of 4,170 completions for their financial year-end.

The “incentives” were offered to buyers just days before Bovis issued a profit warning, stating that 180 homes were “being deferred into early 2017” resulting in profits lower than previously expected. Equity analyst Anthony Codling at investment bank Jefferies, told The Times: “This will be where they are trying to make their targets. They would have been trying their hardest to complete those homes to get people moved in before Christmas. There is pressure from an investor perspective to meet the volume target and they will do what they can to meet those targets.”

Other analysts said that the cash incentives from Bovis were part of a failed attempt by the FTSE 250 company to meet City targets saying Bovis’ share price had “substantially underperformed the sector over the last seven years.”

Have Bovis Group attempted to deceive investors and the City as to the true year-end results of the Company, by pushing through legal completions (sales) on new homes that were not 100% finished at year-end? I am no expert on financial reporting regulations but more is here. Perhaps this is something that the Financial Conduct Authority [FCA] should be investigating.

Outraged buyers have taken to social media complaining about Bovis asking them to legally complete on unfinished homes with no driveways, windows, paths, gardens, unpainted walls and even the wrong kitchen units being installed. The Facebook Group “Bovis Homes Victims” now has over 1,000 members, as media reporters and others join to find out what buyers are saying about the company on the Closed group.

Rob Elmes, 32, told The Times he refused to accept an initial offer of £2,000 to complete on a three-bedroom £320,000 home in Worcestershire and was offered £3,000 four days later to legally complete on 23rd December. Mr Elmes refused, saying that his home was not yet finished with workmen still in the house and his drive unfinished. To compound matters, Bovis have even managed to fit the wrong kitchen!

Bovis have admitted that customers had been offered an incentive to complete before the year’s end, but claimed that no one was forced to move in before Christmas.

A spokesman from Bovis said: “Customers were clearly free to decide their preferred course of action. The Group often offers a range of incentives at sale and completion in line with industry practice.”

The firm said that all homes “were habitable”, with the required industry certification as per the Council of Mortgage Lenders’ Handbook Rules. A Bovis spokesman said: “A limited number of customers were offered an incentive to complete before the year end and all homes were habitable with the requisite CML industry certification, with a timetable for outstanding finishing works to be carried out in the New Year”

However the reality would appear to be different and members of the Bovis Victims Facebook Group were quick to add their experiences. One member who has asked not to be named, said she was initially “told she was due to move to her new Bovis home in October.” She posted: “We were offered £2,000 by Bovis to complete early on 23 December and told we’d be able to move in to our home over a month later on January 27th. We decided not to take the offer due to the shaky legality and were assured this wouldn’t affect the build. We’ve just been informed our anticipated completion has now moved to 31 March”

How could these homes be regarded as “habitable”? It can hardly be substantially complete if it will take up to three further months to complete the “outstanding finishing works.”

On 23rd December, posts on the group included: “Bovis want us to complete today and move in and [sic] the end of January.” Another Bovis buyer claimed that even if they had accepted Bovis’ cash offer they were unable to legally complete because Bovis had “not completed the correct Help to Buy document.” In addition, forcing or coercing buyers to legally complete on unfinished houses is not new. One posted that they were “put in a hotel for 10 days as Bovis would not wait till after Christmas back in 2013. They wanted to complete asap. Been a fight ever since”

Bovis told The Guardian: “We recognise that our customer service has to improve and the leadership of the organisation is absolutely committed to getting this right.” This came just two days after Bovis CEO David Ritchie “resigned” who admitted a “limited number” of customers were offered an incentive to complete before the end of the year, but no one was forced to move in.

Bovis Apologises

On another Bovis development, the company has finally bowed to pressure and has apologised to buyers for problems at two sites in Norfolk. A Bovis’ spokesman said:

“We are working with our customers at Costessey and Cringleford to resolve their issues and we take their complaints very seriously. We recognise that in some cases at these locations we have not provided the standard of home that we pride ourselves on, for which we apologise. We also recognise that our customer service has to improve and we are absolutely committed to getting this right and are taking actions to put in place robust procedures and practices to rectify issues such as these and prevent them from occurring again.”

My award for ‘best headline’ currently goes to The Sun with “Bovis and Butthead”

Council of Mortgage Lenders (CML) Rules

The CML website states:

“Under rules introduced in April 2003, to help eliminate the practice of builders allowing occupation before the home is completely finished, the Council for Mortgage Lenders’ (CML) initiative requires builders to obtain a completion certificate. This is issued by an independent Building Inspector, normally the NHBC, following a satisfactory final inspection of the property. The lender requires this completion certificate, along with confirmation that the new home warranty is in place, before they release the mortgage funds.It is common for the Final Inspection to be made 14 days before the completion date. This will give the solicitors and mortgage provider time to arrange for the funds and provide you with an opportunity to inspect your finished home.”

Could those Bovis buyers, in accepting the “incentive” payments and legally completing on an unfinished and uninhabitable new home, be innocently complicit with Bovis Homes, the solicitors and the warranty inspector in potential mortgage fraud? The homes would not have been in the condition on completion and therefore the full value, that the lenders believed. Even more, those bought using Help To Buy may have, proportionally, also defrauded the taxpayer!

The Council of Mortgage Lenders told me:

“We can’t comment specifically on these cases in relation to mortgage fraud, as I am sure you’ll understand. I think our members will be concerned about the emergence of this practice, [payments to buyers to legally complete on unfinished new homes] however – as you rightly point out, this practice shouldn’t be able to happen as the properties must be inspected and signed off as complete for habitation; the use of a cash incentive will also potentially distort the true value of the property if the valuer is unaware of it.For clarity, the CML does not have its own ‘certification’ process in relation to new homes completion. We think this reference is probably to the CML Lenders’ Handbook, which is a set of instructions to conveyancers. In that, it stipulates that lenders require a form of new home warranty (such as an NHBC warranty) to be in place prior to completion, which the conveyancer checks as part of the conveyancing process. This requirement was introduced some years ago to prevent this very issue. It may be useful to contact warranty providers, to establish how they think this might be happening.”

Indeed it might; so I did. I asked the NHBC how it was possible for a CML final inspection certificate to be ‘signed off’ by the NHBC inspector? Especially when some of these houses were clearly far from finished requiring in one case, three months work! Another had not been decorated.

The NHBC said:

“All homes registered with NHBC are inspected at key stages of construction. This includes a pre-handover inspection, which is designed to ensure that the property is fit for occupation and that our 10-year warranty cover can be provided. Where people do experience issues with their new homes we offer protection under our warranty for 10 years, including a free Resolution service in the first two years. We would encourage homeowner (or constituents) with concerns about their new home to get in touch with us so that we can offer them our help.”

Not exactly enlightening is it? Again, how is it that any of these homes are judged finished and “fit for occupation”? On 6th January, NHBC Chief Executive Mike Quinton quit after four years – three days ahead of David Ritchie’s “resignation” as Bovis’ CEO.

Under the CML rules introduced in April 2003, a lender will not release the mortgage funds for a new property until the buyer’s conveyancer has received confirmation, in the form of a cover note, that the property has received a satisfactory final inspection and that a full new home warranty will be in place on or before legal completion. In an excellent article (March 2010) Building.co.uk highlighted that the “A Guide to the CML Certificate” ended with a warning stating that: “If [the consultant] signs the certificate and defects are subsequently found to affect the property, it is highly likely that they will face a claim on their professional indemnity insurance some way down the line.”

Under the CML rules introduced in April 2003, a lender will not release the mortgage funds for a new property until the buyer’s conveyancer has received confirmation, in the form of a cover note, that the property has received a satisfactory final inspection and that a full new home warranty will be in place on or before legal completion. In an excellent article (March 2010) Building.co.uk highlighted that the “A Guide to the CML Certificate” ended with a warning stating that: “If [the consultant] signs the certificate and defects are subsequently found to affect the property, it is highly likely that they will face a claim on their professional indemnity insurance some way down the line.”

You also have to question quite what, (if anything) the buyer’s solicitor entered into the CML “Disclosure of Incentives form” (Section 10) for those that chose to take the Bovis’ incentive!

HBF Buyers’ customer survey ratings

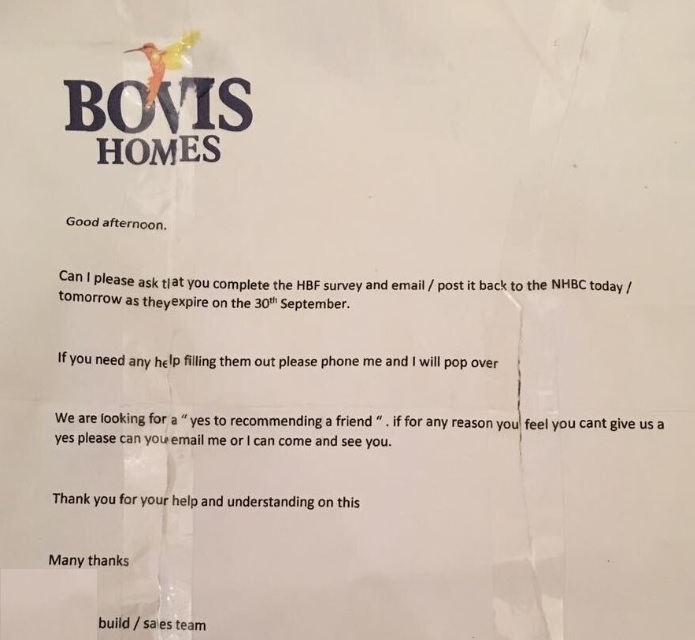

It would appear that Bovis are also manipulating the HBF Customer Satisfaction Survey. Bovis Homes, rated just three stars by its customers for the last two years, has allegedly offered John Lewis vouchers to buyers in return “for giving good feedback on the NHBC survey” Whilst not uncommon within the industry, this is clearly against the HBF Star Rating rules 21,22,24 and 25.

It would appear that Bovis are also manipulating the HBF Customer Satisfaction Survey. Bovis Homes, rated just three stars by its customers for the last two years, has allegedly offered John Lewis vouchers to buyers in return “for giving good feedback on the NHBC survey” Whilst not uncommon within the industry, this is clearly against the HBF Star Rating rules 21,22,24 and 25.

Barratt, Persimmon and Taylor Wimpey distance themselves from this latest scandal

Last Thursday Tom Knowles reported in The Times that the country’s biggest housebuilders were distancing themselves from the scandal, in particular Bovis’ claims that cash payments to buyers to legally complete on unfinished homes was “in line with industry practice.

The scandal has led to Oliver Colvile MP, chairman of the All Party Parliamentary Group For Excellence in the Built Environment, to call for a debate into the standard of new homes, he said: “We will try to have a debate in the House of Commons about the quality of new-build housing. We need to press the government to do more.” In July last year, Mr Colvile and a group of MPs published their Inquiry Report detailing ten recommendations, which included my suggestion that buyers or their surveyors, have a mandatory right to inspect their properties before they complete their purchase. Many Bovis new home buyers have complained they were not allowed to enter their homes until the day of completion and on doing so, discovered workmen attempting to complete the works in time.

In a statement Bovis suggested offering cash to customers to complete by a certain date was “in line with industry practice”, but the three biggest housebuilders, Barratt, Persimmon and Taylor Wimpey, said that they never make this offer. Ryan Mangold, chief financial officer of Taylor Wimpey, said: “We have never given cash incentives to get buyers to move in by a certain date.” Peter Truscott, chief executive of Galliford Try, said that while developers occasionally offered investors buying several homes, cash incentives to complete by a set date, this was not the case for individual customers. The Home Builders Federation said: “It is not common industry practice to offer cash to new home buyers to complete early.”

However, a Persimmon homebuyer posted on ‘Unhappy New Home Buyers’ Facebook Group:

“I read that about this morning in The Mail. Persimmon tried this on lots of our purchasers including us in 2010, but for some reason we had put our money in a 6 month Bond and told them where to go…..needless to say we won….but our neighbours moved in with Windows missing!, Trouble is it did not do us any good because we had so many problems, and still have some, we pay out for some things ourselves, but some [sic] we live with!”

A spokesman for Bovis told The Times:

“Each individual customer was approached on a case-by-case basis and, where appropriate, they were offered the opportunity to move into their homes in time for Christmas with an agreed timetable for outstanding finishing works to be carried out in the New Year. Customers were offered help in the form of payments for a range of reasons in light of the extra costs they would incur by doing so . . . Similarly, some customers were offered compensation payments as a gesture of goodwill in light of the added disruption over the festive period.”

The scandal is so serious that several MPs have said they could raise the issue in Parliament. Among them are Labour MP Melanie Onn, former Tory housing minister Mark Prisk and as mentioned earlier, APPG EBE Chairman Oliver Colville MP. However the fact of the matter is that issues such as these are not new. The APPG EBE ‘Inquiry Into the Quality of New Homes In England’ found that “as the number of homes being built increased, the quality of new homes has declined.” The Inquiry Report painted a damning picture of a broken industry, bereft of any moral compass. It said:

“The evidence points to an industry…which will at times ride rough-shod over dissatisfied buyers… House builders should be upping their game and putting consumers at the heart of the business model…For some, purchasing their dream home turns into a nightmare…Evidence suggested there is a continuing issue with poor standards of workmanship in new homes…At financial half-year and year-ends, the quality is reduced as they rush to meet targets…Housebuilder’s own quality control systems are not fit for purpose…The government must take a lead role to make sure house builders deliver a quality product and service and not just focus on numbers being built.”

Debate or no debate, it is to be hoped that the forthcoming Housing White Paper due later this month, does indeed take note of the ten recommendations of the APPG Inquiry Report and includes measures to address the ongoing quality and service shortfalls of the major housebuilders, especially by undertaking to set up an independent New Homes Ombudsman before the end of this year.

It is my opinion that the buyers’ quotations in this article, reproduced entirely as they were originally written on posts freely available on Facebook, would be considered by a reasonable person, to be true and the opinions or experiences of these private individuals. This article is my honest opinion of the buyers’ own claims and statements that any reasonable person might also conclude. I believe this is a matter of public interest.