Home Builders Federation (HBF) 8-week “Satisfaction” Survey 2018

So six months after the industry’s in-house “customer satisfaction ” survey year-end on 30 September 2017, the HBF have finally released the results. So what do they say to the new home buying British consumer?

The HBF claim “Homeowner satisfaction with new homes remains high”

Despite the HBF survey responses being repositioned this year, (with the key question “Would you recommend your builder to a friend?” buried in the third row!) the ongoing failure of this industry to its customers cannot be hidden.

FACT: Whilst the “Would you recommend your builder to a friend?” key star rating question score this year was 86% – up 2% on last year’s nine-year low of 84%, it is still at the same level it was in 2011 so no improvement.

“As output has risen, so quality has fallen – The evidence points to an industry…..which will at times ride rough-shod over dissatisfied buyers”+++ This demonstrated by the fact that 4% fewer would recommend their builder, would buy another new home from any housebuilder.

Credit is due for the slight increase the number of surveys issued and the percentage returned. Out of 156,120 new homes built by housebuilders in the survey year, 93,444 (73%) surveys were sent out to the 127,800 private new homebuyers with 57,972 (62%) returned. Avant, rated 2 stars in 2016 are now 4 star rated in just two years, with a 193% increase in their “sample size” over that period.

The HBF say their Star Rating scheme:

“awards participating members a star rating based on the survey results is now an established barometer of performance and a widely used industry marketing tool. The survey also helps participating members identify areas they can improve and is used by HBF to rebuff unwarranted criticism of our industry.”

“Identify areas they can improve”

Taylor Wimpey have been rated 4 stars for the last 4 years, one of the few housebuilders to publish their actual percentage for the key star rating question – 87% (2014); 86% (2015); 85% (2016) and 88% in 2017. Just a 1% improvement over three years! Persimmon have been 3 star rated every year over the same period.

Survey results “used by HBF to rebuff unwarranted criticism of our industry.”

Survey results “used by HBF to rebuff unwarranted criticism of our industry.”

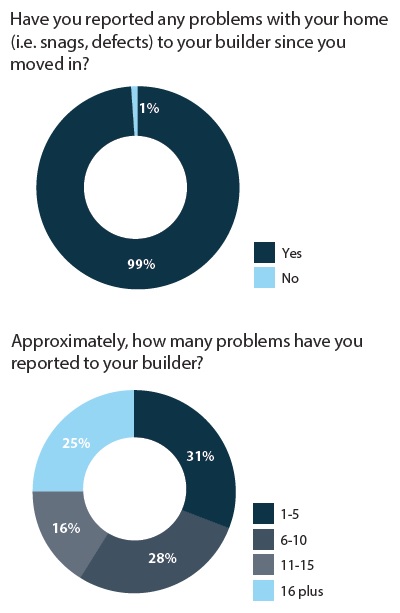

Well they try to. The fact is, 99% of homebuyers reported defects in their new homes to the housebuilder within a few weeks of moving in. For the second year, 41% reported more than 10 defects. Imagine if virtually all new cars had defects? If housebuilders built cars, many would be on our roads with defective brakes and wheels falling off!

Why does the HBF not publish individual builder results for every question?

John Stewart HBF Director of Economic Affairs told me back in 2011:

“From a personal perspective, I think publishing more detailed company results would not have had any more impact on raising customer satisfaction among new home buyers. But it would most certainly have provided food for those who are prejudiced against the industry and simply seek to criticise. I see no value in this.”

Yet according to HBF chief Stewart Baseley who is by his own admission says he is “a great believer in transparency” – “achieving such high levels of customer satisfaction, whilst delivering the steepest increase in the rate of house building we have seen for 40 years, is a considerable achievement.”

Considerable achievement? Well Bovis are still rated just two stars. This despite building 332 FEWER new homes last year – a drop of over 8% on the previous 12 months, according to the company, to “focus us once again on delivering high quality product and service to our customers.” Bovis have became the only plc housebuilder to be rated 2 stars in consecutive years, with less than half of Bovis’ buyers completing the survey.

Quality and satisfaction are not the same

To many, being “fairly satisfied” does not indicate full satisfaction, yet the structure of the HBF survey adds the “fairly” score to the “very” to get the overall “satisfaction” score the HBF publish. In addition, a heavy emphasis is placed on the Yes/No responses to “would you recommend your builder to a friend?” It could be argued that many would, give a ‘Yes’ purely on the basis their experience was “not that bad” rather than “terrible” which would be a ‘No’. This is borne out by the result from the second question: “how likely would you recommend your builder to a friend?” with just half indicating a positive response. In addition: “NHBC 9-month customer satisfaction survey scores generally 5-10% LOWER than the HBF 8-week survey”+++ These 9-month survey responses have never been made public!

The HBF claim these latest results: “once again prove the industry’s commitment to achieving the highest levels of customer service and satisfaction. The results have been achieved over period that saw the steepest increase in house building activity we have seen for 40 years.”

Well not exactly. The number of total new homes built in 2017 was 162,490 still below the peak of 168,640 to 30 March 2007. As for the “prove industry’s commitment to achieving the highest levels of customer service” this is a disgraceful statement considering the nightmare that thousands of new homebuyers are suffering across the country, due to the ineptitude of indifferent housebuilders. Tell that to the 11,000* buyers – equating to 8.4% of all new homes completed in 2017 – that make an NHBC warranty claim every year, 30% ** of which are within the initial two-year period when housebuilders are responsible!

“In addition to the high level of Customer Satisfaction revealed by the survey, the industry also has its own self-imposed Consumer Code, ensuring customer concerns are heard and that disputes can be resolved through an independent adjudication system.”

Self imposed? The requirements are derived from the Consumer Protection from Unfair Trading Regulations 2008. Customer concerns regarding poor quality, defects and warranty issues are not covered by this Code which “does not appear to objectively to offer consumers a wholly satisfactory form of redress and is limited in its scope”+++

“The survey results and the Code, in addition to a ten-year warranty on all new homes, combine to give new build home purchasers genuine confidence in the product they are buying.”

“The survey results and the Code, in addition to a ten-year warranty on all new homes, combine to give new build home purchasers genuine confidence in the product they are buying.”

A survey with results used by this industry to “rebuff unwarranted criticism” and for marketing, an ineffective Code “limited in its scope” and warranties that seeks to bat away claims.

Let’s face it; this in-house industry survey is easily manipulated. All housebuilders can see their customer’s responses in real time on the NHBC portal, enabling them to incentive buyers of their homes to answer positively to the crucial star rating question: “Would you recommend your housebuilder to a friend?” Furthermore 11,803 survey responses were not used for the sample size of the key question. I asked the HBF why and they said:

“The Star Rating part of it is just for HBF members. Hence adding up the sample sizes for the Star Rated builders will not get you to the total 57,972 responses as other non HBF members are sampled as we want to get as full a picture as possible. However, every single valid Barratt response counts towards Barratt’s rating; every single valid Bovis response counts towards their score etc. Valid simply means completed by an owner occupier within the 20 week response window. Not one single valid survey was ‘not used’”

The APPG EBE in the report “More Homes – Fewer Complaints” agreed with me that the survey should be conducted completely independently of the industry. “Recommendation 10: Housebuilders should make the annual customer satisfaction survey more independent to boost customer confidence. We believe it would boost consumer confidence if the Customer Satisfaction Survey is seen to be more independent of the NHBC and the HBF – bringing in a high profile third party to conduct and take ownership of the research….”

The HBF reaction? To attempt to reaffirm via a IPOs MORI review of the survey that said it is “fit for purpose” nevertheless “changes are being implemented in the next survey year.”

It may well be fit for the industry’s purposes, but is not in my opinion, fit to demonstrate rising customer service, satisfaction or that higher quality new homes are being built. In fact it is and always has been, woefully inadequate. Nevertheless, such as it is, it does paint a grim picture of an uncaring industry, hell bent on ever increasing their profits, whatever the consequences for naïve, trusting new homebuyers that believe their spin and hype.

* NHBC annual report to 31 March 2016

** Figures supplied by NHBC

+++ APPG Inquiry Report “More Homes Fewer Complaints” July 2016