Response to consultation and government delay in creating the Statutory New Homes Ombudsman

Another consultation? On 1st October 2018, now ten months ago, the then Housing Secretary James Brokenshire announced the government would create a statutory new homes ombudsman which in his words:

“will champion homebuyers, protect their interests and hold developers to account. And give confidence that when you get the keys to a new home you get the quality build you expect and the finish you’ve paid for.”

It is hugely disappointing that this has yet to take place, meaning tens of thousands of new homebuyers have no available recourse to seek unequivocal, 100% independent redress and meaningful compensation awards for the often nightmare new homes they now own and the indifferent service received from errant housebuilders and inadequate warranty policies.

As the one person that suggested the statutory new homes ombudsman at the APPG EBE Inquiry on 23rd November 2015, I had no idea at that time, it would take this government over 4 years to implement. Many thousands of new homebuyers are aware of the government’s failure to listen to their concerns, hear their pleas and start a long process of change, beginning with the creation of a statutory new homes ombudsman. The government should be aware that the lack of urgency and constant prevarication will lose votes, from homebuyers, their families and friends, whatever their political persuasion.

It is my hope that following this somewhat unnecessary Consultation (closing on 22 August 2019), the statutory new homes ombudsman will become fully operational and not be further delayed by Brexit fallout, political grandstanding and become yet another one of those classic wishy-washy government promises that take a decade to materialise if at all.

It is my hope that following this somewhat unnecessary Consultation (closing on 22 August 2019), the statutory new homes ombudsman will become fully operational and not be further delayed by Brexit fallout, political grandstanding and become yet another one of those classic wishy-washy government promises that take a decade to materialise if at all.

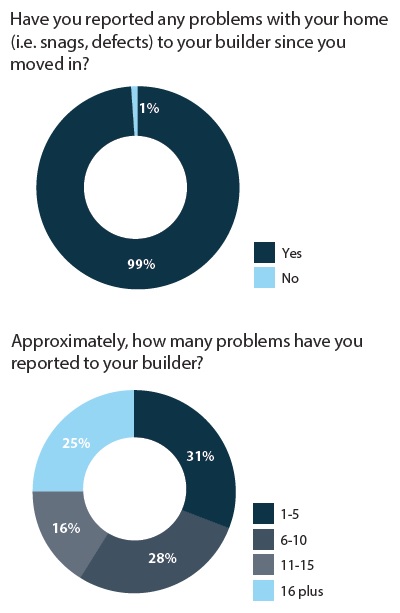

When 99% of new homebuyers report defects to their housebuilder, 43% reporting more than 10 defects* within the first few weeks of moving in and many new homes not even built in full compliance with existing building regulations, clearly government must act.

It has come to my attention that the MHCLG has been giving advice to the Consumer Code for Home Builders (CCHB). The cynic in me is concerned that the CCHB could be being tasked by government, to come up with a watered-down set of rules and requirements agreeable to plc housebuilders and warranty providers, with a view to setting up an industry-led “Ombudsman” perhaps a temporary ‘beta’ version of the new homes ombudsman, ahead of legislation “at the earliest opportunity” “when parliamentary time allows” which will be operated on a voluntary membership basis. Could this even be the “Shadow form” the MHCLG has outlined?

The time for debates, announcements and consultations with stakeholders has passed. It is now time to deliver on the promise made on 1st October 2018 and create a statutory new homes ombudsman.

Too many new homebuyers are suffering, many are physically drained as a result of engagement with indifferent housebuilders when trying to get their new homes brought up to warranty standards and statutory regulations. For some buyers, the mental anguish has become almost unbearable, with some contacting me for help even mentioning thoughts of suicide, such is their hopelessness! Like Yvette Davis and her contaminated uninhabitable Linden new home in Sarisbury Green

New Home Expert’s Consultation responses:

Having completed the online version and answer all the specific questions I also sent in expanded comments some aspects.

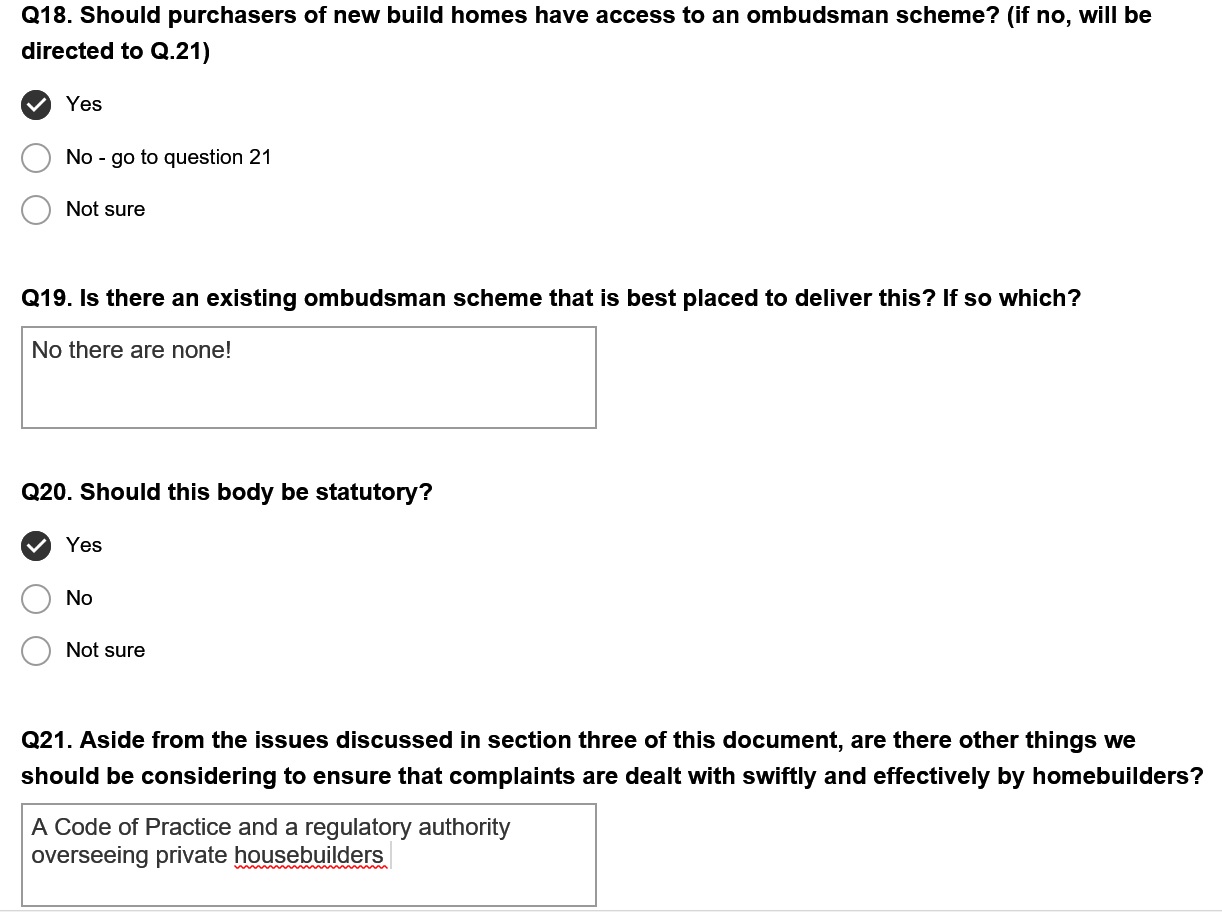

Q4 Who should be covered by the new homes ombudsman

To avoid housebuilders wriggling out of compliance with the statutory new homes ombudsman and depriving new homebuyers of effective redress, it should also encompass anyone who is involved in the selling of new homes or what are effectively new homes as ‘second-hand’.

Q5 Should a New Homes Ombudsman only cover complaints where redress cannot be sought elsewhere?

NO! Clearly the New Homes Ombudsman should cover ALL complaints from new homebuyers regardless of the nature or existence of alternative Ombudsman or redress. The “limited in its scope” Consumer Code for Homebuilders has clearly failed new home buyers over its ten-year existence.

It should also include warranty providers as the Financial Ombudsman Services NHBC complaint decision in Appendix A demonstrates, this despite 71% of complaints against the NHBC being upheld in new homebuyers favour * originally shown here now deleted because, according to Which, The NHBC is a “warranty supplier and not a home insurer” and the data was therefore “not correct.”

Q6 Anyone else able to seek redress through the New Homes Ombudsman?

YES! Anyone who buys a new home from the original buyer within the 10-year warranty period.

Q7 Should anything be excluded from the new homes ombudsman remit?

NO! It should include anything and everything including complaints about new home warranty providers.

FREE – FAIR – FOR EVERYTHING

Q8 Awareness of requirement to belong to the New Homes Ombudsman

The requirement should be a condition of planning and building regulation approval. Building control inspectors and warranty providers should be legally required to seek proof of membership before carrying out inspections.

Q9 Should there only be a single New Homes Ombudsman

YES! It should be single Statutory New Homes Ombudsman administered by a PUBLIC BODY in a way not dissimilar to the Financial Ombudsman Services.

There should not be any form of “voluntary” New Homes Ombudsman, “shadow form” New Homes Ombudsman or any “Ombudsman” scheme or services, created by any of the housebuilding industry’s stakeholders.

Q10b Additional circumstances a purchaser can access the New Homes Ombudsman

- When a sale did not go through and housebuilder is withholding money, such as reservation fees and other payments such as for optional extras.

- It should also cover breaches of written agreements regarding carrying out remedial works to defects.

- When a purchaser of a new home is given a non-disclosure agreement to sign as a condition of carrying out remedial works to defects.

Q12 Should the New Homes Ombudsman be delivered by a public sector body?

YES! Anything less, would be a sell-out to the housebuilding industry and a betrayal of trust to every new-build buyer. On no account whatsoever, should any private sector organisation, either existing or newly created, be allowed to deliver the New Homes Ombudsman. Already the industry’s own Consumer Code for Home Builders (CCHB) is attempting to manoeuvre and reinvent itself as an ‘Ombudsman’ with advice from the MHCLG! The New Homes Ombudsman must be unquestionably, 100% independent of the house building industry and its stakeholders (various Codes and warranty providers) and be clearly seen to be. The only way to ensure and guarantee independence is a New Homes Ombudsman service delivered by the PUBLIC SECTOR.

The MHCLG should take note of the abject failure of deregulation of Building Control function with the use of “approved inspectors” with the now many documented, poor quality standards and examples of non-compliance in “completed” “inspected” and “signed off” new homes.

Q16 Should access to the New Homes Ombudsman be free for purchasers of new build homes?

YES! Any charge to access redress will deter consumers making complaints and questioning their validity. It has been previously announced by government that the New Homes Ombudsman would be free and on Page 41 of the 24 January 2019 response to the last Housing Redress Consultation it stated it would be free. Even on page 17 (3.19) of this consultation it states “we want to see better redress faster so that consumers can benefit from FREE, FAIR and EFFECTIVE redress as soon as possible”

Until this year, the CCHB charged new homebuyers seeking redress £120 (including vat!) as a registration fee. Just 357 complaints were received in 8 years with many no doubt being put off by the fee and the bias of adjudication.

It would be idiotic to have the opinion that a free service would be subject to misuse giving rise to vexatious complaints, as any new homebuyers that angry and frustrated, would in all probability have genuine, justified grounds for making a complaint.

Q17 Funding the New Homes Ombudsman

A simple levy for each and every house built. I am suggesting £100 per home built giving around £20 million on 200,000 homes a year completed. In addition, for each complaint the housebuilder concerned should also pay £750 towards the cost of investigating the complaint and also any additional amounts to cover the cost any independent external specialist’s inspections, assessments and testing.

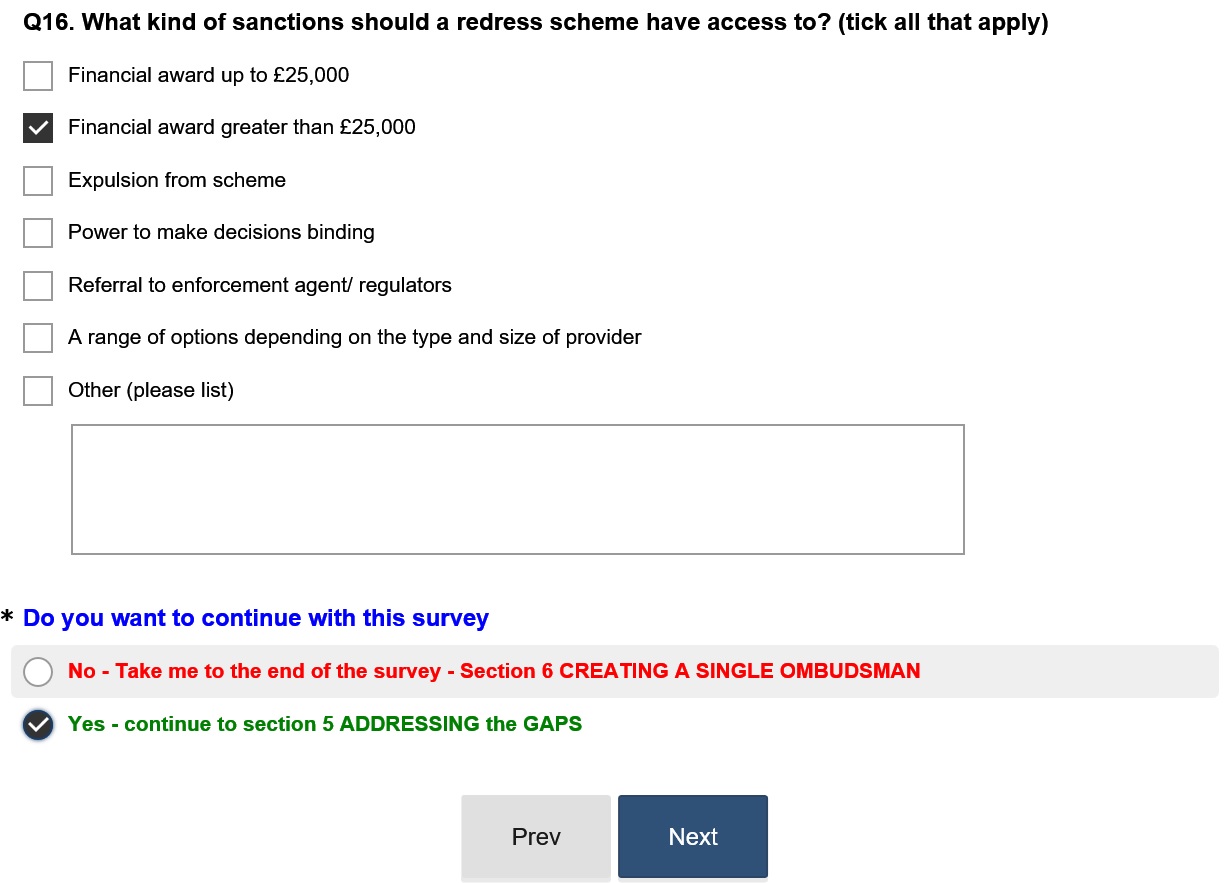

Q20 Sanctions for New Homes Ombudsman

All of the above. In addition, when considering sanctions, expulsion or suspension, this should apply to all companies and regional companies within a plc housebuilder’s group. It should also apply to the directors of those companies. This is to prevent any plc corporation simply using another company within its Group, acquiring another housebuilder or setting up a new company to carry on trading and avoid the Ombudsman sanctions.

Q21 Powers of the New Homes Ombudsman

It is essential that the New Homes Ombudsman has the power to force housebuilders to buy back (‘reverse the purchase’) defective new homes at full market value. This should be offered to the buyers of any new home where defects are serious or extensive enough to require the new home owners to move into temporary accommodation for more than 28 days.

In addition, the New Homes Ombudsman should have the powers to stop work on any development where serious defects are reported, such as weak mix mortar, missing fire barriers and structural issues. In all such serious instances, the New Homes Ombudsman should INFORM all other home owners on any particular development, that their home may have a serious defect(s). This will nullify the use of non-disclosure agreements by both plc housebuilders and warranty providers to cover up their shortcomings and limit their financial liabilities.

The purpose of a New Homes Ombudsman is to make meaningful, justifiable levels of compensation awards to new homeowners, taking into full account the impact on their family life. It should not just exist to enforce the rectification of defects and ensure any financial loss is reimbursed. This should ensure that housebuilders are suitably encouraged to improve quality and service. Each case should be judged fairly on its merits, in most cases compensation awards of less than £2,000 will be insufficient, as it will be cheaper for plc housebuilders to write-off the Ombudsman’s award for the few buyers that take their complaint to the New Homes Ombudsman against the cost of improving quality for every new home built.

Q22 Maximum award by New Homes Ombudsman

This should be up to £200,000, in line with the Financial Ombudsman Service upper limit. A home is the most expensive purchase anyone makes in their lifetime; indeed, it can take a lifetime to pay off the loan. The upper limit must therefore properly reflect the investment, thus the likely cost of a total demolish and rebuild, to properly cover those new homebuyers who do not wish to take advantage of the buy-back option.

By implying that taking legal action is an option for larger claims would dismiss its impossibility for most new homebuyers. For even those with legal expenses insurance, this is a lengthy and costly process with no guarantee of a successful and just outcome. Indeed, housebuilders have deep pockets and vigorously defend every attempt by the very few new homebuyers who take this course of action, in the full and certain knowledge that it will cost less to defend the small number of claims that could potentially end up in court, than routinely pay justifiable compensation to homebuyers. Even if an agreement is reached ahead of a court hearing, this is normally subject to a non-disclosure agreement clause, (“gagging order”) to avoid any precedent being established and to reduce likelihood of action being taken by others, often with identical issues.

By implying that taking legal action is an option for larger claims would dismiss its impossibility for most new homebuyers. For even those with legal expenses insurance, this is a lengthy and costly process with no guarantee of a successful and just outcome. Indeed, housebuilders have deep pockets and vigorously defend every attempt by the very few new homebuyers who take this course of action, in the full and certain knowledge that it will cost less to defend the small number of claims that could potentially end up in court, than routinely pay justifiable compensation to homebuyers. Even if an agreement is reached ahead of a court hearing, this is normally subject to a non-disclosure agreement clause, (“gagging order”) to avoid any precedent being established and to reduce likelihood of action being taken by others, often with identical issues.

Taking legal action against a plc housebuilder is a serious barrier to access to justice, in terms of cost, risk and time. As I said on national television, “Buyers who go to court will run out of money long before the housebuilders ever will.” Most having just bought a new home at a premium price, perhaps using help to buy, cannot simply afford long and protracted legal battles with plc housebuilders and their bullying ‘Rottweiler’ litigation mitigation solicitors.

Q23 What information should be published to empower consumers?

There should be a builder league table, revised bi-annually naming house builders and the number of complaints made against them to the New Homes Ombudsman. It should detail the number of complaints upheld, amount of awards and compensation, with statistics divided into categories such as pre purchase, defects and poor quality, non-conformance with building regulations and unfair terms and charges.

In time, this incorruptible government data, should replace the industry’s own, in-house and highly criticised ‘8-week HBF survey’ designed with the sole intention of “providing data to rebut negativity” and completed by purchasers at a time when the full extent of defects and their housebuilder’s indifference are unknown. Indeed the NHBC have said that the responses to its 9-month survey, which is never made public, show the satisfaction levels are normally 5-10% lower than those in the 8-week survey.

Q26 Should a New Homes Ombudsman remit be UK-wide

Whilst there is a case for this, given most plc housebuilders have operations in the devolved nations and clearly have the same need, it will inevitably result in further legislative delay. For this reason the Statutory New Homes Ombudsman should apply only to England with devolved nations free to copy or amend their own legislation if they choose to do so.

The nations were devolved for a reason and have autonomy to change and revise their own building regulations, so why, if they feel a statutory New Homes Ombudsman is required, would they not be able to act and create their own? A requirement for a UK-wide New Homes Ombudsman would only serve to delay implementation.

Q28 What should be included in a Code of Practice for developers?

Obviously everything listed in the consultation should be included, but any industry collaborated/created Code of Practice will invariably be used to limit or restrict the redress available to new homebuyers and the effectiveness and powers of the New Homes Ombudsman (as is the case with the industry’s own CCHB). This must not be allowed.

The New Homes Ombudsman must not be confined to decisions from any Code requirement not met. Each and every complaint should be judged in its own individual merits. Whilst the FOS does make reference to the ‘Banking Code’ and the ABI ‘Statement of general Insurance Practice’ it does not appear bound to them implicitly. Neither should the Statutory New Homes Ombudsman be restricted in what it can and cannot rule on.

FREE – FAIR – FOR EVERYTHING

It must be said, that the universal practice of housebuilders encouraging, incentivising and in some cases insisting, new homebuyers to use a particular solicitor of the housebuilder’s choice must be banned. Clearly this practice leaves buyers at a distinct disadvantage as there is a clear conflict of interest. This being demonstrated by the harm thousands have suffered as a result of being led into leasehold ownership of houses, without fully understanding the implications and disadvantages of doing so. Housebuilders recommending/suggesting solicitors (because “it will be quicker/easier as they know the development and have already done the searches”) should and must be banned. Until it is, this should be included under the New Homes Ombudsman remit.

3 Conclusion

The housebuilders and warranty providers operational policy is to bat away buyers’ complaints and warranty claims rather than work in the consumer’s best interests. Despite many years of opportunity, nothing has changed. It is now time, as the previous Consultation recognised, a Statutory New Homes Ombudsman is required to award justifiable and meaningful levels of compensation. It needs creating now, as a government priority, without further and unnecessary delay.