The great weak mix mortar scandal – Part Three

My first article highlighted the weak mortar scandal and the reasons why the industry has now widely adopted factory manufactured ‘just add water’ mortar, along with technical reasons which might explain why incidence of weak mortar in new homes is increasing. My second article I followed up on “Britain’s crumbling new homes” on the BBC2 Victoria Derbyshire programme on 6 December 2018.

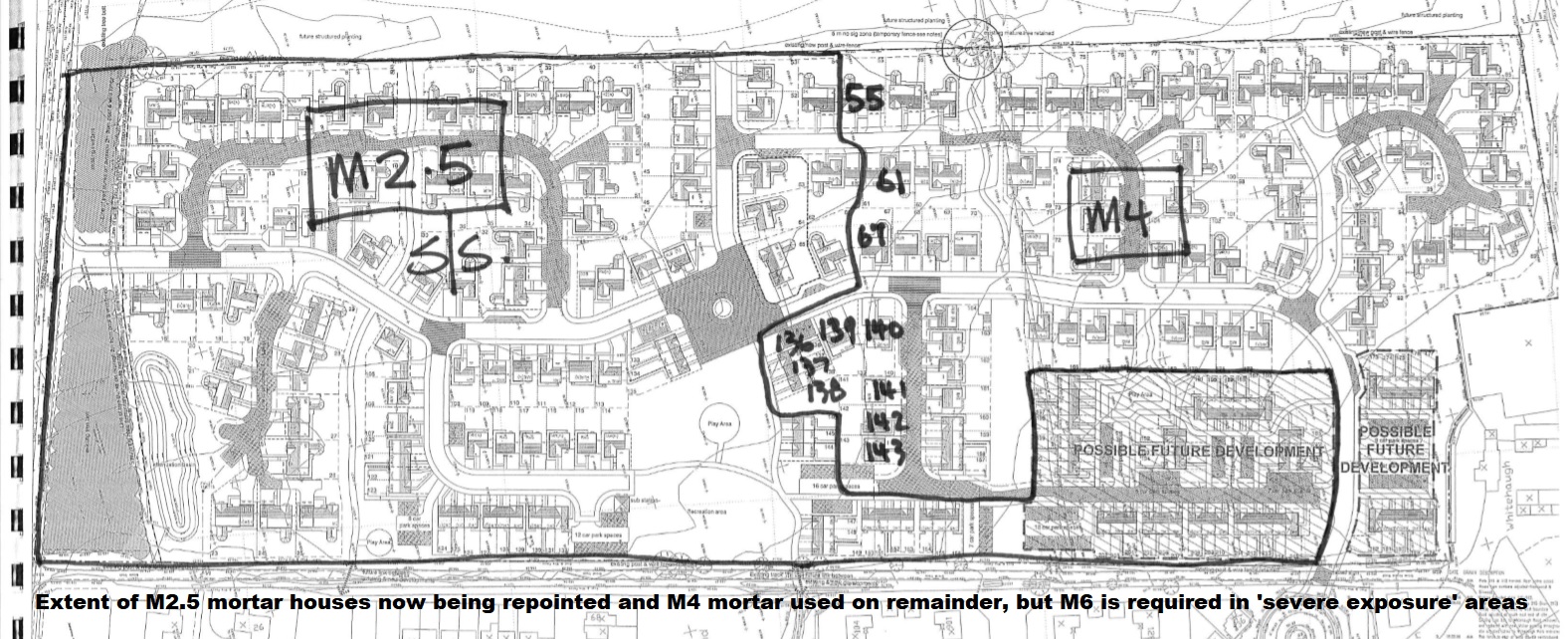

So in this part three article, I will expand on last week’s BBC Victoria Derbyshire story featuring 130 homes built using an incorrect M2.5 weak mix mortar on the Taylor Wimpey ‘Kingsmeadow’ development at Kittlegairy in Peebles and the seven homeowners’ 2-year battle with Taylor Wimpey.

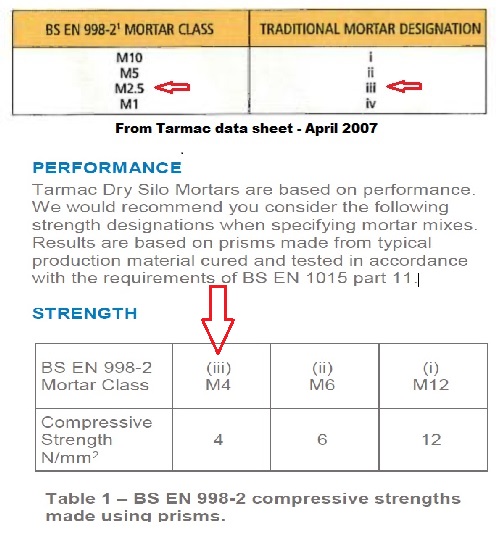

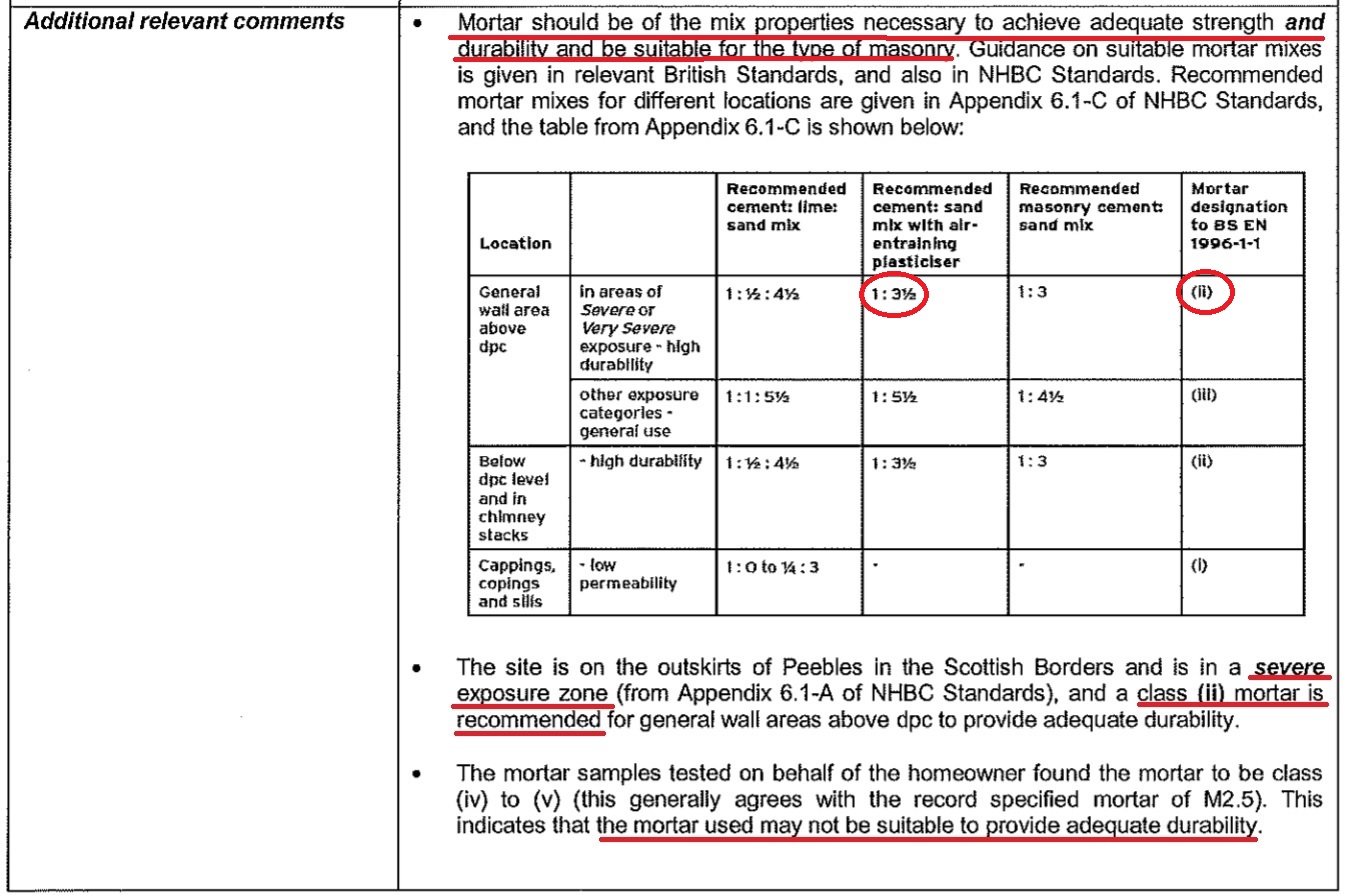

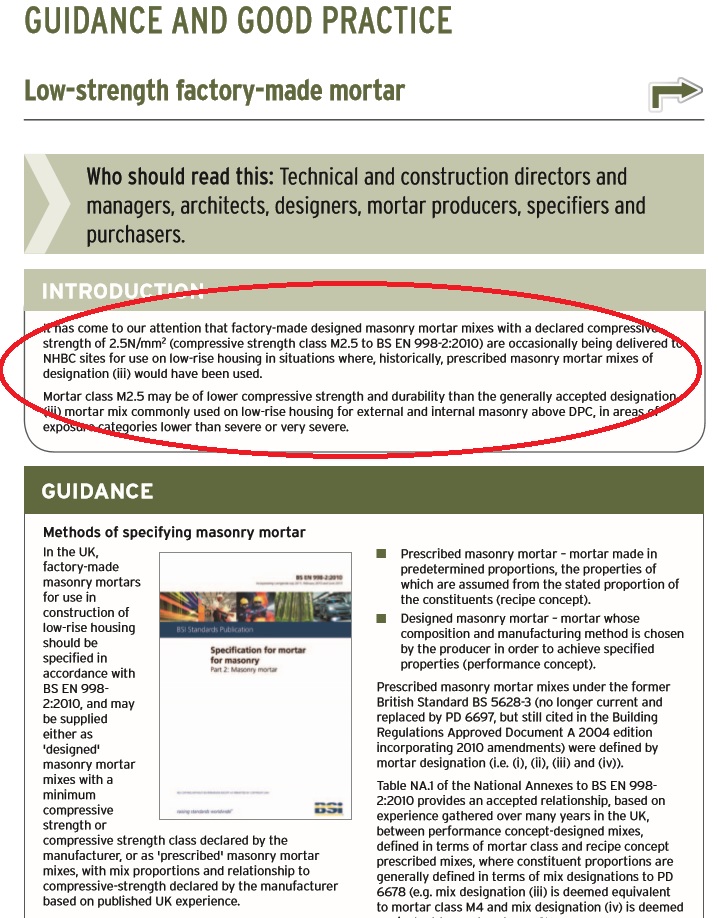

In 2008, Taylor Wimpey started building houses in Kittlegairy, Peebles, approved by Scottish Borders Council with designation (iii) prescribed mix mortar specified. That is mortar with a cement content of 14% – 17% and deemed equivalent to an M4 factory produced design mix mortar. Unbeknown and undeclared to Scottish Borders Council, Taylor Wimpey, for reasons as yet unknown, used a Tarmac silo M2.5 design mix which had a cement content 6% less than that approved and under HALF the cement content required (M6 or 1:3-4) to meet the NHBC warranty standard for areas of severe exposure, in which this development is located.

Tarmac Silo Design Mix Mortar

Peebles homeowner Sheila Chalmers first contacted me for advice in October 2017 and featured on the programme. She told me: “In 2008, the Tarmac Mortar Specification Sheet (as supplied by Taylor Wimpey) stated that their M2.5 mix was the equivalent strength of (iii). This has changed since (I do not know when) with Tarmac’s current literature saying that their M4 is now the equivalent of (iii).” Tarmac also state on their website: “The mix proportions of Tarmac dry silo mortar conform to values specified in the following table when tested by the methods prescribed in BS EN 1015 and BS 4551.”

Peebles homeowner Sheila Chalmers first contacted me for advice in October 2017 and featured on the programme. She told me: “In 2008, the Tarmac Mortar Specification Sheet (as supplied by Taylor Wimpey) stated that their M2.5 mix was the equivalent strength of (iii). This has changed since (I do not know when) with Tarmac’s current literature saying that their M4 is now the equivalent of (iii).” Tarmac also state on their website: “The mix proportions of Tarmac dry silo mortar conform to values specified in the following table when tested by the methods prescribed in BS EN 1015 and BS 4551.”

Tarmac recently confirmed to me that their PDF data sheet (April 2007) sent to homeowners by Taylor Wimpey is genuine. Perhaps Taylor Wimpey used this data sheet when considering which design mix was required to match the specified designation (iii) equivalent mortar?

Taylor Wimpey attempts at concealing the issue

Taylor Wimpey attempts at concealing the issue

Sheila told me that around 2011/12 and unknown to the rest of the estate at that time, a house had started to show signs accredited to weak mortar, this being raised with Taylor Wimpey, the NHBC and the Scottish Borders Council. It was discovered that an undeclared change from prescribed mix mortar to design mix mortar had taken place. Sheila said “It was all kept very quiet with Scottish Borders choosing to not alert home owners that their houses may start to fail over the coming years.”  In the years that followed, houses started to empty, with people literally disappearing overnight – Taylor Wimpey were buying back houses. Sheila indicated that “probably around 10 or 12 houses but it was still being kept hushed up. People were signing gagging orders and therefore kept quiet. Taylor Wimpey’s solution at the beginning of this, was to buy back the homes and silence the homeowners with non-disclosure agreements” Apparently some of the homeowners recently confirmed that Tradecast the repointing contractor, had been put under “severe pressure” by Taylor Wimpey and were instructed not to acknowledge any issues when challenged by homeowners. “In the early days, Taylor Wimpey were wanting Tradecast to park off-site and take taxis onto the estate in order to keep the problem quiet”

In the years that followed, houses started to empty, with people literally disappearing overnight – Taylor Wimpey were buying back houses. Sheila indicated that “probably around 10 or 12 houses but it was still being kept hushed up. People were signing gagging orders and therefore kept quiet. Taylor Wimpey’s solution at the beginning of this, was to buy back the homes and silence the homeowners with non-disclosure agreements” Apparently some of the homeowners recently confirmed that Tradecast the repointing contractor, had been put under “severe pressure” by Taylor Wimpey and were instructed not to acknowledge any issues when challenged by homeowners. “In the early days, Taylor Wimpey were wanting Tradecast to park off-site and take taxis onto the estate in order to keep the problem quiet”

On 28 September 2016, four years after the mortar started to crumble on the first home, Taylor Wimpey wrote to home owners admitting “some of the homes” did not meet the requirements of the NHBC. It outlined a 20-year extension warranty cover for mortar on every home on the development. Apparently then, if any homeowner was concerned, Taylor Wimpey would inspect with their engineer. Shelia told me that “as would be expected most did, with the majority being informed that there was nothing wrong with their houses, this despite owners now “scratch testing” their own mortar and seeing it crumbling away.” More owners began having their own mortar tests done with a wide variety of results, from between designation (i) 30% cement, to below (iv) less than 10% cement

Sheila said that Scottish Borders Council were coming under increasing heavy pressure from concerned homeowners and, after several families provided their structural results to the Council, it was forced to arrange its own structural assessment which carried out by Harley Haddow, on a random selection of houses within the development on 17 May 2018 . The Harley Haddon report had similar findings as the owners’ structural reports and giving a 10-year timeframe “the mortar will weather, will subsequently weaken and will undoubtedly result in failure” for the properties built with M2.5 mortar.

Harley Haddow’s report, shared with Taylor Wimpey, ultimately resulted in Taylor Wimpey letter on 19 September 2018 to all houses built with M2.5 mortar. It advised homeowners, despite Taylor Wimpey’s original rejection of repair works in many cases, that it has now finally agreed to carry out repointing works if the homeowner requested. The company still maintains that “only some houses in phase one have a durability issue and a significant number of houses where no issues have been identified.”

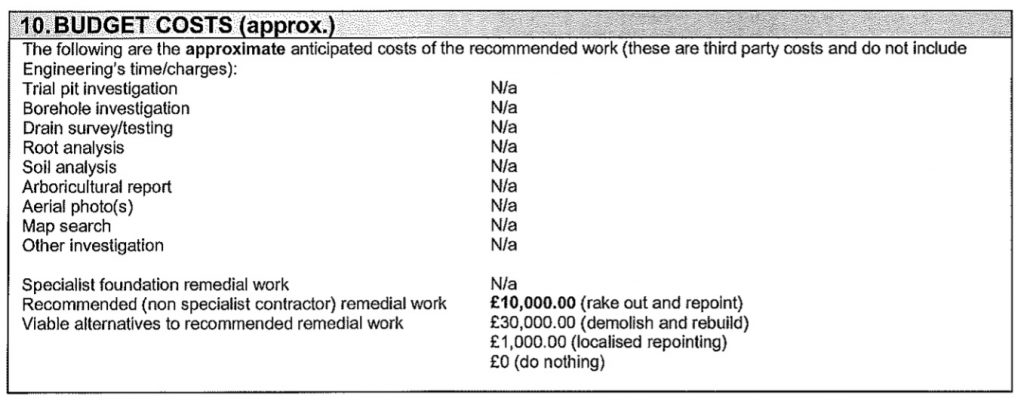

So despite Taylor Wimpey stating in their 2016 letter: “we are fully committed to carrying out the works that are needed for the remaining affected homes as soon as possible” nevertheless, over three years later, homebuyers like Sheila have had a long battle with Taylor Wimpey to arrive at such an undertaking. Sheila says that “we felt that at that time if there was a problem, Taylor Wimpey would step up and rectify the problem no questions asked.” The repointing Taylor Wimpey has finally agreed to “falls way short of what we should all be getting, ie, knock down and rebuild of our properties.”

So despite Taylor Wimpey stating in their 2016 letter: “we are fully committed to carrying out the works that are needed for the remaining affected homes as soon as possible” nevertheless, over three years later, homebuyers like Sheila have had a long battle with Taylor Wimpey to arrive at such an undertaking. Sheila says that “we felt that at that time if there was a problem, Taylor Wimpey would step up and rectify the problem no questions asked.” The repointing Taylor Wimpey has finally agreed to “falls way short of what we should all be getting, ie, knock down and rebuild of our properties.”

“…the repointing of joints on walls where purposeful demolition and reconstruction should have happened”

Jo Churchill MP for Bury St Edmonds House of Commons debate (13 Dec 2017)

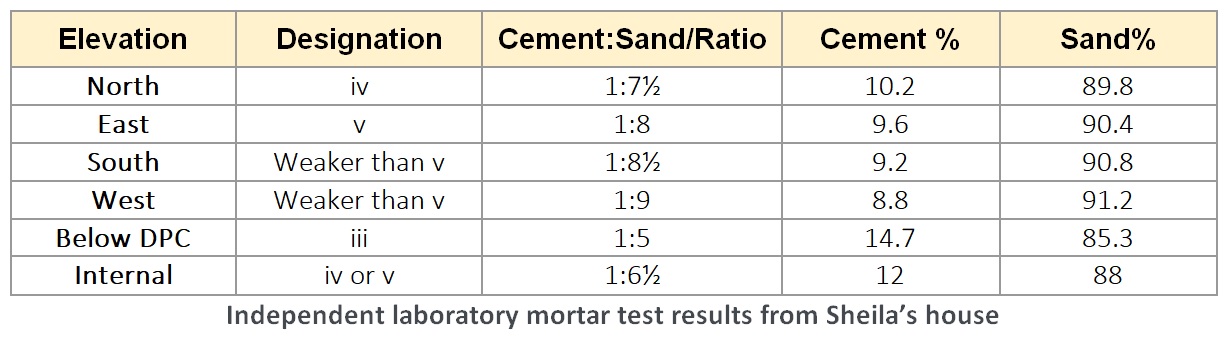

Even in statements for the BBC Victoria Derbyshire programme last week, Taylor Wimpey maintain that raking out and repointing with M6 mortar, which they have now finally agreed to carry out for Sheila during this summer, is still considered by them not to be necessary for Sheila’s home. This despite independent laboratory analysis of the mortar her home was built revealing as low as 8% cement content. It is interesting to note that Taylor Wimpey used Alastair Dick from David R Murray Consulting Engineers the same consultants that produced some of the engineering plans who have been involved in the project all along, can hardly be considered independent. When Sheila spoke to Mr Dick a couple of weeks ago, he told her “he was now relieved that Taylor Wimpey had agreed to repoint all the houses.” Sheila said, “you’ve knocked mine back several times” he told her “… there was a lot of pressure on them before the agreement was put in place.”

However, Taylor Wimpey told the BBC that the tests Sheila and her neighbours used were “not appropriate.” It said “The weaker mortar used on some of the houses is of sufficient strength to meet structural requirements… but it may present as less durable under prevailing exposure conditions” “May”?

However, Taylor Wimpey told the BBC that the tests Sheila and her neighbours used were “not appropriate.” It said “The weaker mortar used on some of the houses is of sufficient strength to meet structural requirements… but it may present as less durable under prevailing exposure conditions” “May”?

The good news is the internal mortar with 13% cement content just under the lower end of the 14% for M4 mix so could possibly be structurally sound. However the cement content of the remainder of the external walls falls below even M2.5. Of particular concern is the mortar used below ground which should have been a 1:3 mix as it is often saturated and subject to the actions of freeze thaw, even more likely in this area.

The 25mm deep raking out of mortar joints and repointing works will only improve durability and does not address the issue of the potentially weakened bond with the wall ties, reducing the stability and integrity of the cavity wall, which could in certain conditions, result in external walls becoming unstable and dangerous on exposed elevations. However, it is interesting to note that wall tie pull out tests, arranged by Taylor Wimpey and witnessed by Harley Haddow, found a pull out of 1KN or more, greater than the anticipated tension loads of 0.6KN and “the tensile capacity had not been demonstrably compromised by the bedding mortar’s friability. “

It is unimaginable, the extreme anxiety, worry and mental anguish that at times, must have been almost unbearable and detrimental to health, suffered by Sheila and her neighbours. This coupled with the expensive legal fees (around £350 an hour), structural survey fees and the cost of mortar testing which basically forced Sheila’s household into debts totalling £16,000, all caused by Taylor Wimpeys’ intransigence and the NHBC’s ongoing denial of what I believe, is a wholly valid warranty claim, over the last 24 months. Sheila told me “this could have all been avoided if Taylor Wimpey had admitted it instead of trying to bat this away and lie through their teeth. They knew all along when they built this bodged Estate but were quite happy to lie to us and say all is well, forcing us to spend huge sums (I am not the only one) to prove it. Legally, they don’t even have to reimburse our fees despite us proving all this.” Although Taylor Wimpey has told the BBC they will now do so.

Sheila’s neighbours three doors away, Pete and Jill Hall also had a 2-year fight on their hands with Taylor Wimpey. They too had independent testing of their weak mortar, which in the worst case showed their garage had such a small cement content it could be considered to be built with virtually wet sand! After a heated meeting with Taylor Wimpey’s solicitors, Dentons UKMEA LLP, during which the Halls outlined the only options they would accept either: 1) Buy back the house, 2) Demolish it entirely and re build as it should have been or 3) Carry out works required to bring it to the standard it should be; much to their astonishment they received a letter from Taylor Wimpey’s solicitor. It said they were considering reporting the Halls under “Proceeds of crime legislation” with allegations of “clear and specific threats linked to demands of money and offering to conceal information if such money was paid and other demands met” Not quite as Taylor Wimpey claim “we always aim to do the right thing for our customers?”

Sheila’s neighbours three doors away, Pete and Jill Hall also had a 2-year fight on their hands with Taylor Wimpey. They too had independent testing of their weak mortar, which in the worst case showed their garage had such a small cement content it could be considered to be built with virtually wet sand! After a heated meeting with Taylor Wimpey’s solicitors, Dentons UKMEA LLP, during which the Halls outlined the only options they would accept either: 1) Buy back the house, 2) Demolish it entirely and re build as it should have been or 3) Carry out works required to bring it to the standard it should be; much to their astonishment they received a letter from Taylor Wimpey’s solicitor. It said they were considering reporting the Halls under “Proceeds of crime legislation” with allegations of “clear and specific threats linked to demands of money and offering to conceal information if such money was paid and other demands met” Not quite as Taylor Wimpey claim “we always aim to do the right thing for our customers?”  Now two years on, Taylor Wimpey has made an offer to the Halls. Jill told the BBC “It falls short of where we think a proper full repair should be but they [Taylor Wimpey] have basically turned round and said it’s that or nothing….I would never buy a new house again”

Now two years on, Taylor Wimpey has made an offer to the Halls. Jill told the BBC “It falls short of where we think a proper full repair should be but they [Taylor Wimpey] have basically turned round and said it’s that or nothing….I would never buy a new house again”

Notwithstanding the site-wide weak mortar, apparently this development also had other “workmanship” issues. As noted in Harley Haddow’s report: they “found examples of what we consider poor overall site quality control, over and above that of the mortar.” This including: poor restraint strapping details, homes with garden rooms where foundations are misaligned, missing wind posts in some house types and external DPCs below ground level. Shelia says “and the list goes on with regards to boilers and heating systems supplied.”

What about the NHBC? “Protecting homeowners”?

Shelia asked the NHBC reinspect her house and yet again it rejected her warranty claim saying that despite obvious gaps and holes in mortar joints there is no evidence of physical damage. At that time Sheila tells me the NHBC were made aware that M2.5 mortar had been used and not the M6 required for severe exposure areas and required in the NHBC warranty standards, but still “they would not budge”. Even the NHBC’s own inspector report concluded that the mortar class used throughout this development “indicates it may not be suitable to provide adequate durability”

“Once mortar deteriorates it will compromise the rest of the brickwork.” BDA

The final response from the NHBC:

Sheila’s home is now outside the 10-year warranty (by 5 months) and as far as the NHBC are concerned “that’s end of the matter”. The NHBC said:

“I should advise you that this is unlikely to change our view on liability. Section 3 of the Buildmark policy provides cover for actual physical damage to the home that was caused by a defect in a part of the property listed in the policy document if the cost of repair is more than the minimum claim value. Regardless of whether, or not it is identified that there is a defect with regard to the specification and/or preparation of the mortar mix this item is not covered by the policy in the absence of actual physical damage to the home.

The construction is now 10 years old and during this time the mortar can be considered to have generally performed, given that there is little sign of erosion to date to indicate any failure within the compressive strength of bedding material used and/or impair the structural integrity of the load bearing walls. As such, the criteria that is required for a valid claim under the terms of the policy has not been met.”

This, despite three separate independent Structural Engineers reports concluding: in the longer term (beyond 10 years) the mortar will weather, will subsequently weaken and will undoubtedly result in failure.”

So much for the NHBC:

So much for the NHBC:

“Preventing problems before they happen and being on hand when they do” Their own technical materials requirement R3 in the warranty standards states: “All materials products and building systems shall be suitable for their intended purpose” That is having “a life of at least 60 years.”

In my opinion, the NHBC are behaving abysmally regarding the issue of weak mix mortar. It is a serious issue which the NHBC have been aware of for many years. As far as I am aware there is no research being carried out to discover why it is on the increase. The NHBC has not revised its standards to prohibit the use cement substitutes such as GGBS and PFA or to require regular ongoing site testing of mortar used.

NHBC Technical Newsletter July 2000 Issue 20:

“The consequences of getting it wrong are well known to NHBC. At the least it may mean raking out all joints and repointing and at worst it can be removing the outer leaf and rebuilding. The problem is that too little cement is added to the mix to ensure that the strength is achieved and, perhaps more importantly, the hardened mortar is durable.”

In addition, the NHBC’s Technical Extra Issue 11 in September 2013 (Page 22) specifically warns against using M2.5 design mix factory mortars.

The NHBC spent a total of £94.6million on remedial works on warranty claims in the 12 months to 31 March 2018, around 11,000 claims a year. Around £28 million for claims made during the first two years. Superstructures (walls including render/floors/roof) accounted for around 38% of the total cost of claims in 2015/16. The NHBC has reserves of £462million and additional investment assets totalling £1,560million. This non-profit distributing organisation, can well afford to do right by those new homeowners with weak mix mortar policyholders.

The NHBC spent a total of £94.6million on remedial works on warranty claims in the 12 months to 31 March 2018, around 11,000 claims a year. Around £28 million for claims made during the first two years. Superstructures (walls including render/floors/roof) accounted for around 38% of the total cost of claims in 2015/16. The NHBC has reserves of £462million and additional investment assets totalling £1,560million. This non-profit distributing organisation, can well afford to do right by those new homeowners with weak mix mortar policyholders.

Taylor Wimpey is currently repointing 130 homes in the M2.5 area of the development, but not those built using M4 mortar. Taylor Wimpey said they “sincerely apologise to the homeowners affected… we are fully committed to resolving matters” They claim “this is a localised issue and falls short of the high standards we uphold. We are committed to carrying out the works that are needed to the remaining homes as soon as possible” However, Taylor Wimpey’s latest letter advises that it considers it is not under any obligation to undertake this work and it is committed to complete all repointing work within three years! Sources on site, tell me their contractor Tradecast is aiming to complete repointing works on 90 houses by the end of this year and surprisingly, some homeowners being unwilling to have the work done at all.

Taylor Wimpey is currently repointing 130 homes in the M2.5 area of the development, but not those built using M4 mortar. Taylor Wimpey said they “sincerely apologise to the homeowners affected… we are fully committed to resolving matters” They claim “this is a localised issue and falls short of the high standards we uphold. We are committed to carrying out the works that are needed to the remaining homes as soon as possible” However, Taylor Wimpey’s latest letter advises that it considers it is not under any obligation to undertake this work and it is committed to complete all repointing work within three years! Sources on site, tell me their contractor Tradecast is aiming to complete repointing works on 90 houses by the end of this year and surprisingly, some homeowners being unwilling to have the work done at all.

Sheila has raised a formal complaint against the NHBC through their complaints team.

The NHBC’s 86-year old ‘go-to’ “mortar expert” Barry Haseltine stated in his report:

“I recall that, up to 2012, Tarmac were concerned that achieving a strength of 4N/mm2 would require them to use more cement than they would have done in a prescribed mortar of the equivalent designation, (iii). I suspect that the designation (iii), M4, was used throughout; however from what I can see of the mortar quality in photographs taken by the Claims Investigator, there is nothing that I can call damage within the NHBC definition of the word. The house is structurally sound and should remain so for a normal life. There is no need for any remedial work.”

Barry Haseltine basing the statements in his report from NHBC photographs and never visited Sheila’s home and inspected it himself.

The NHBC would appear to base their rejection of the M2.5 mortar when M6 is required purely on the basis it hasn’t (as yet) structurally failed in the last 10 years!

Taylor Wimpey Annual Report 2018 (27 February 2019)

This specifically makes reference to Sheila’s development although again, plays down just how potentially serious and expensive it could be for its shareholders.

“We acknowledge concerns raised by some of our customers in connection to mortar durability on a development in Peebles, Scotland. While a significant number of houses on the development are unaffected, a robust technical solution, supported by an appointed structural engineer and the NHBC, to fix the durability of the mortar has been identified and homes are being remediated as soon as possible”

This despite the company knowing about the weak mortar issue in 2011 and all homes built using a mortar not considered sufficiently durable for the severe exposure location of this development!

It would appear that Taylor Wimpey also have structural failings on their 2013 development ‘The Chariots’ in Andover. As I understand it, the roofs to 75 homes are being removed, work which will take 2 months per house to complete.

Taylor Wimpey 30-year weak mortar warranty

In their letter dated 28 September 2016, Taylor Wimpey undertook to provide a total of 30-year warranty up to 31 December 2045, for “issues specifically caused by mortar quality” for EVERY home on their ‘Kingsmeadow’ development in Peebles. This does not include what it refers to as “fair wear and tear” but “defective mortar which has failed to maintain its strength and durability” It would appear the mortar warranty is only for the external mortar which can be seen. Amazingly, Taylor Wimpey also said it “takes such concerns seriously and stand by the quality of our construction.”

Obviously in 2045 everyone will have departed this mortal coil and CEO Pete Redfern will no doubt be keeping ex-Persimmon CEO Jeff Fairburn company, stoking the fires of hell. It will be interesting to see whether the correct mortar (M6) is used on the adjacent development land. I very much doubt any works will begin until long after the current repointing works are finished.

Obviously in 2045 everyone will have departed this mortal coil and CEO Pete Redfern will no doubt be keeping ex-Persimmon CEO Jeff Fairburn company, stoking the fires of hell. It will be interesting to see whether the correct mortar (M6) is used on the adjacent development land. I very much doubt any works will begin until long after the current repointing works are finished.

For those wishing to take legal action against their housebuilder, the case of Halvorson v Persimmon Homes 2018 (Scotland) is case law which determined that all NHBC warranty standards form part of the contract and non-compliance of any guidance or recommendations could be judged as a breach of contract.

A sea-change of behaviour is required

It is time the tin-eared, corporate bean counters running the nation’s plc housebuilders did the right thing right away and stopped trying to minimise what are huge issues like weak mortar. First with denial, then the great cover up, using non-disclosure agreements limit their exposure. Finally, as on this Peebles development, when a weak mortar issue became widely known, threatening, intimidating and mentally torturing its own customers for two years before finally agreeing to undertake repointing works to all 130 houses. This has got to stop!

This whole industry lacks moral integrity. It says one thing, then does the opposite, frequently exposed lying and cheating its own customers, concealing the extent of defective homes and quietly carrying on with apparent impunity from this weak government.  It is to be hoped that the current Housing Secretary James Brokenshire is good on his word and legislates for the statutory new homes ombudsman which in his words: “will champion home buyers, protect their interests and hold developers to account.” as a matter of urgency, a government priority, rather than as current, “when parliamentary time allows.” Make time!

It is to be hoped that the current Housing Secretary James Brokenshire is good on his word and legislates for the statutory new homes ombudsman which in his words: “will champion home buyers, protect their interests and hold developers to account.” as a matter of urgency, a government priority, rather than as current, “when parliamentary time allows.” Make time!

Until government acts, new homeowners like Sheila and her neighbours will be left wondering, in the words of the Pet Shop Boys,

“How I’m gonna get through ……….what have I, what have I, what have I done to deserve this.”