Persimmon Homes announces an “independent review of workmanship, culture and customer care”

Following on from Persimmons announcement last month of its 1.5% homebuyer retention scheme, made in response to growing criticism about the quality of its homes, Britain’s worst housebuilder – rated only 3 stars by its own customers five years in a row, is now launching an independent review of its customer care, culture and workmanship as part of an attempt to move on from the executive pay scandal and complaints about its defective homes. The wide-ranging, independent review will be led by Stephanie Barwise QC of Atkin Chambers, and will look into Persimmons customer care approach, systems and culture, quality assurance processes, and the speed and consistency of its response to issues. The company intends to publish the findings towards the end of 2019. It seems strange that Persimmon has chosen to employ a QC to conduct its independent review. However with her “expertise lies in civil engineering and construction disputes” and “considerable experience in alternative dispute resolution methods including adjudication and mediation.” perhaps not.

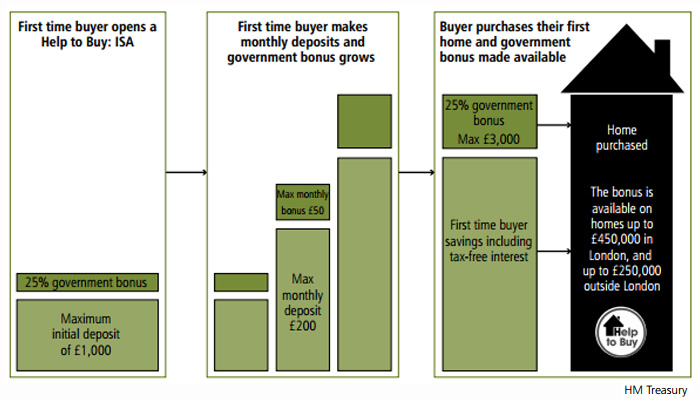

The wide-ranging, independent review will be led by Stephanie Barwise QC of Atkin Chambers, and will look into Persimmons customer care approach, systems and culture, quality assurance processes, and the speed and consistency of its response to issues. The company intends to publish the findings towards the end of 2019. It seems strange that Persimmon has chosen to employ a QC to conduct its independent review. However with her “expertise lies in civil engineering and construction disputes” and “considerable experience in alternative dispute resolution methods including adjudication and mediation.” perhaps not. Since the introduction of Help to Buy in 2013, Persimmons share price has more than doubled. Persimmon relies heavily on the scheme with almost half of its buyers having used Help to Buy last year.

Since the introduction of Help to Buy in 2013, Persimmons share price has more than doubled. Persimmon relies heavily on the scheme with almost half of its buyers having used Help to Buy last year.

In a company statement Persimmon said:

“Persimmon has been focused on rapid change and improvement of its customer care culture and operations, and on eliminating cases of poor workmanship. To assess the effectiveness of the new measures and processes and to determine whether they appropriately position the business for the future, Persimmon’s board … has commissioned an independent review.”

This Persimmon “independent review of its culture, workmanship and customer care” looks to me little more than a plastic, public relations stunt designed to obtain some credibility with third parties and a government that has already indicated it is mindful to suspend Persimmons access to Help to Buy. Even the death of a 4-year old child caused by a defect in a Persimmon home didn’t force change, but as soon as James Brokenshire threatens to take away access to the Help to Buy gravy train, Persimmon make two press release announcements in as many weeks!

Persimmons culture is one of unparalleled boardroom greed. Driven by a hunger for increasing profits year on year, whatever the cost, with total indifference to its reputation, build quality and its customers.

Year after year Persimmon has said in their annual reports:

In 2016, Jeff Fairburn said:

“The Group’s priority is to serve our customers well by providing good quality new homes and great service. During 2015 we invested substantial resources in new customer focused initiatives to improve our customers’ buying experience and our NHBC/HBF 3 star rating.”

In 2017, it was repeated:

“During 2016 we have continued to invest additional resources in new customer focused initiatives to improve our customers’ buying experience and our NHBC/HBF 3 star rating.

In 2018:

“Delivering good quality new homes with a high standard of customer service is a priority for the Group. Although we have increased our build numbers significantly in recent years, our quality control procedures and increased use of standard house types have helped to maintain our build quality.”

This year Persimmon said:

“Delivering a good quality product for our customers and providing high levels of customer service throughout the home buying process is a top priority for the business.” and more recently: “we hear the message that we need to continue to raise our game in customer care.”

Do Persimmon Homes really need an in-depth, independent review of the way it has been operating to find out where it could, if it chose to do so, improve? It is inconceivable that those on the board haven’t known for many years what they are doing, building very poor quality defective new homes and what they are most definitely not doing, putting their customer first. Why do Persimmon routinely refuse to allow buyers’ professional snagging inspectors access before legal completion? “Company policy” they tell their customers”

Persimmon could ask their employees. Here is what a Contracts manager no less said about the company!

Ask the thousands of unhappy customers

They could ask their buyers 13,476 members on the Facebook Group Persimmon Unhappy Customers’ There are many stories like this online, going back many years. Persimmon even made a counter claim against one of their buyers for the cost of repairs to his home! Persimmon appear to go out of their way to be confrontational and intransigent to any customers who take issue with the builder. The phrase “the Customer is always right” isn’t even on their radar if this story from the North East Evening Chronicle is anything to go by. Persimmon failed to fix defects for nine months in this house.

They could ask their buyers 13,476 members on the Facebook Group Persimmon Unhappy Customers’ There are many stories like this online, going back many years. Persimmon even made a counter claim against one of their buyers for the cost of repairs to his home! Persimmon appear to go out of their way to be confrontational and intransigent to any customers who take issue with the builder. The phrase “the Customer is always right” isn’t even on their radar if this story from the North East Evening Chronicle is anything to go by. Persimmon failed to fix defects for nine months in this house.

Why don’t they also publish their 9-month NHBC customer survey results for the last 5 years? Plenty in there to show those head burying, bean-counters on the board that are now, apparently, so keen to discover where it all is going wrong!

So do you really need a root and branch “independent review” of your business practices at Persimmon. It’s obvious what is wrong when you do things like this?

“They chop down trees, build shoddy homes and go to the lavatory. On Wednesdays they sell dodgy leaseholds and have buttered scones for tea!”

Cutting down around 260 trees and more than 80 metres of hedgerow from the eastern boundary of their Millennium Farm development is hardly going to improve Persimmons public image. North East Lincolnshire Council believe Persimmon have “breached planning regulations”, and has launched an investigation to discover whether they have been working outside their agreed terms.

Persimmon built homes with missing cavity fire barriers. In Cornwall In Devon with their development in Cranbrook was the first development site identified. In fact this could be a widespread systemic omission/defect. Perhaps Persimmon owe it to their customers to be conducting an independent review into why and how hundreds, maybe thousands, of their new homes can be built with a potentially fatal defect.

When it is discovered by buyers they first deny it then say it is limited to one site. Eventually forced to check many developments as the issue becomes known to BBC Watchdog. The difference between Persimmons financial performance and customer satisfaction is so stark, this, surely, is an area where the government should take an interest.  Yet the most we have heard are comments from James Brokenshire, the housing secretary, that he will be “considering carefully” how developers that are part of an updated Help to Buy scheme from 2021 should “meet the standards and quality that customers expect and deserve”. We’ve heard it all before James – nothing has changed! Be careful, as voters will remember you as ‘James Brokenpromises’

Yet the most we have heard are comments from James Brokenshire, the housing secretary, that he will be “considering carefully” how developers that are part of an updated Help to Buy scheme from 2021 should “meet the standards and quality that customers expect and deserve”. We’ve heard it all before James – nothing has changed! Be careful, as voters will remember you as ‘James Brokenpromises’

Persimmons latest headline grabbing homebuyer retention scheme is strangled by restriction and limited only to the defects buyers spot the day they get their keys. How daft do Persimmon think we all are?

These smokescreen PR gestures will not change Persimmon. In fact, I firmly believe that once the company has fooled government and secured approval to continue with the next extension of Help to Buy, the homebuyer retention scheme will be quietly ended and the independent review report will be ignored, gathering dust on a boardroom shelf. If Persimmon did really want to change, it needs to do much more and even then, it will take a generation to repair its terrible reputation as Britain’s worst housebuilder.

UPDATE: 17 December 2019 The waiting is over as Persimmon Homes publish the findings of their independent review. They admit there are some “difficult truths to confront” and they intend to take time and formulate a “Persimmon Way” of building. Only time will tell if this shambolic company is really serious and genuine in its intention of improving its poor quality and service to buyers, or whether this is just another smokescreen PR exercise to divert attention from the media spotlight.