The great weak mortar scandal – Part Two

Following my first article exposing the weak mortar scandal, many more new homebuyers have contacted me. It would appear this issue is both widespread and serious. Whatever causes their mortar to crumble, sometimes in under a year, both housebuilders and warranty providers are doing everything they can to limit their costs and keep weak mortar issues quiet, out of the public gaze. The NHBC provide warranty policies for around 80% of all new homes built in the UK. Defective superstructures, which include external walls, is their most common cause of claims accounting for 41% of all claims in the year to 31 March 2017, costing the NHBC £27.2million. Weak mortar cannot be considered as minor snagging, this is the rectification of serious defects often affecting the structural integrity of the home. It cannot be explained away by the industry as a few “isolated cases” either.

The NHBC provide warranty policies for around 80% of all new homes built in the UK. Defective superstructures, which include external walls, is their most common cause of claims accounting for 41% of all claims in the year to 31 March 2017, costing the NHBC £27.2million. Weak mortar cannot be considered as minor snagging, this is the rectification of serious defects often affecting the structural integrity of the home. It cannot be explained away by the industry as a few “isolated cases” either.

Are NHBC Warranty Standards “Raising Standards – Protecting homeowners”?

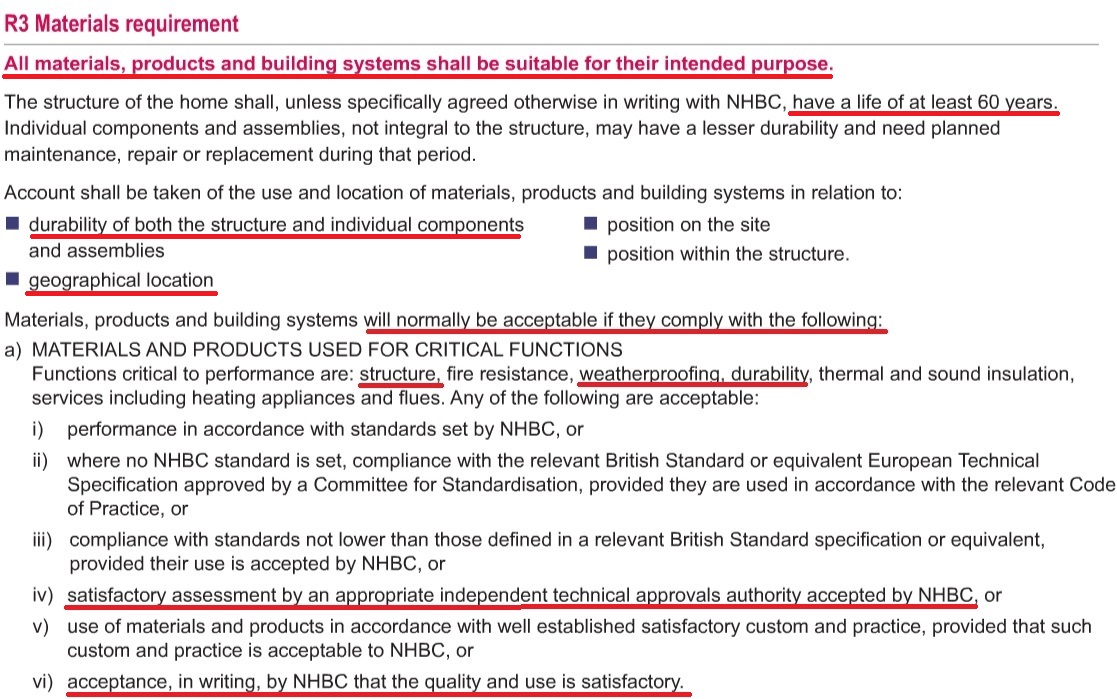

The NHBC Warranty Standards are in general, recommendations or guidance as a means of compliance, with just five absolute Technical Requirements (in red) “these are mandatory and must be met by the builder”

Regarding weak mortar, two stand out. R2 Design Requirement;

“Design and specification shall provide satisfactory performance” and R3 Materials Requirement; “All materials products and building systems shall be suitable for their intended purpose” That is having “a life of at least 60 years.” If Performance Standards (in black bold) are followed, the Technical Standard for that particular work will be met. The NHBC are quick to highlight to buyers that the remainder of the warranty standards are just Guidance on how the Performance Standards may be met and surprisingly, are not mandatory. The NHBC have stated that “failure to follow that guidance does not constitute a non-compliance” [with warranty standards]

If Performance Standards (in black bold) are followed, the Technical Standard for that particular work will be met. The NHBC are quick to highlight to buyers that the remainder of the warranty standards are just Guidance on how the Performance Standards may be met and surprisingly, are not mandatory. The NHBC have stated that “failure to follow that guidance does not constitute a non-compliance” [with warranty standards]

With regard to mortar, the Performance Standard is 6.1.14 “Mortar shall be of the mix proportions necessary to achieve adequate strength and durability and be suitable for the type of masonry…”

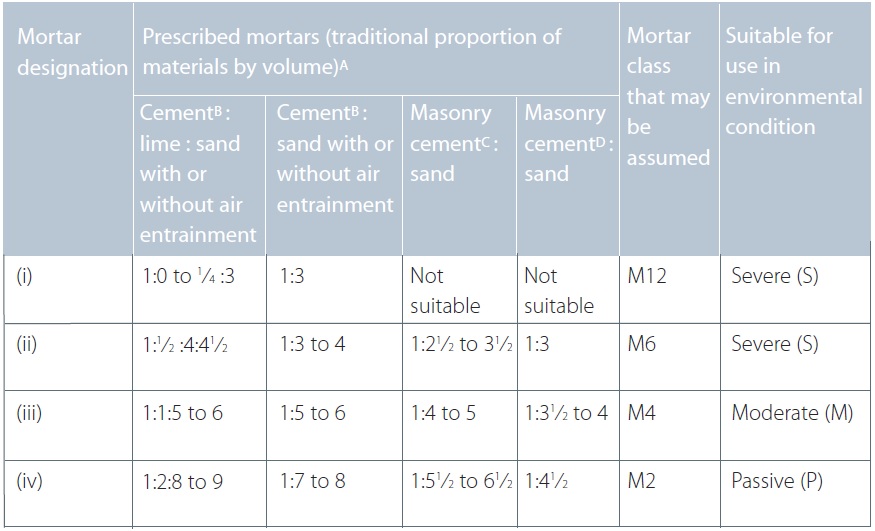

The Guidance table then state various mix proportions which enable the Performance Standard to be met, using Portland or sulfate resisting cement. No mention is made of cement replacement material such as GGBS. Clearly mortar with an insufficient cement mix proportion, namely less than that stated in the NHBC Standards “guidance” table (from BS EN 1996-1-1), will not meet the “adequate” performance standard required. It is certain that mortar which is crumbling and falling out of joints is not suitable for its intended purpose neither is it of “satisfactory performance”.

So what are the NHBC responses when new homeowners who make a claim under the warranty for crumbling mortar?

“We can never guarantee that a property will be defect free”

“The mortar was tested with a flat blade screwdriver [dragged over the surface] and examined for defects”

“I am advised that the cement/lime/aggregate ratios provided in our Standards are guidance only”

“We remain of the opinion……….. to rake out to a depth of 25mm and repoint are [sic] an acceptable method of repair”

“Where issues relating to mortar are concerned, we predominantly rely upon visual assessment of the performance of the mortar to determine our opinion on whether the mortar complies with our Standards.”

“It is the problem associated with exposure and weathering which is the main factor when determining remedial works required”

“Repointing the external walls of your home will ensure our Technical Requirements are met”

“Jenkins and Potter Consulting Engineers [Barry Haseltine] were tasked with providing an independent opinion on the durability and strength of the mortar to your home and provide any necessary recommendations for repair.”

“Under our standards the builder must ensure the Technical Standards are met. Mr Haseltine remains of the opinion that repointing works recommended, if carried out using a specialist contractor, will ensure the durability of the external walls and will also meet NHBC Technical Requirement R3.“

This does not necessarily make the weak mortar behind the repointing “suitable for its intended purpose”

“I am advised that the overall strength of the brickwork comes from the compressive weight of the brickwork and mortar”

“The builder is responsible for putting right anything covered by Buildmark that isn’t built to the NHBC requirements. If we don’t consider that the resolution service is appropriate, or if you don’t accept the findings in our report, we may advise you to consider another form of dispute resolution. Bear in mind that your concerns were raised during the builder warranty period (first 2 years), so any action you take will need to be against the builder and not us.”

“You have the right to refer your complaint to the Financial Ombudsman Service (FOS)…. Some aspects of our Resolution service do not form part of our insurance regulated services”

Indeed they do not as the FOS have confirmed to me:

“Generally during the first few years of the policy the cover they provide isn’t an insurance product. And isn’t something we can look in to. “We can’t investigate when NHBC are acting to mediate under their resolution service. But if the resolution report isn’t complied with (deadlines for work are missed for example) the insurance element kicks in and we can then investigate.”

Mortars of Mass Degradation – Prescribed or Design mix?

A “prescribed mix” is one where the mortar is made in pre determined proportions, the properties of which are assumed from the stated proportions (recipe concept). A “design mix” is a mortar whose composition and manufacturing method is chosen by the producer in order to achieve specified properties a compressive strength (Performance concept) The M number being the expected compressive strength in 28 days so an M4 design mix mortar should attain a strength of 4n/mm2. Mortars are given a designation ranging from (i) highest cement content to (iv) lowest under BS EN 1996-1-1.

Mortar manufacturers can now infer the mix proportions of their mortar from compressive strength. BS EN 998-2 states the relationship between compressive strength and mix proportions for a limited range of strengths and mortar compositions in Table 2.

“Whichever type of mortar, in terms of its constituent materials, is chosen, its durability will be enhanced

as the cement content is increased” BDA

NHBC “leading mortar expert” Barry Haseltine (85)

When a buyer makes a claim under the NHBC warranty eventually the NHBC normally dispatch their “leading mortar expert” Barry Haseltine (85) to the home. Having seen more than one of his reports, I was surprised by the similarity, with identical ‘cut and paste’ paragraphs, despite being at opposite ends of the country, different housebuilders, different mortar suppliers and different mix analysis results. Haseltine alludes to the fact that the mix proportions in the NHBC Standards mix are “a recommendation” and have not been revised since the use of factory produced ‘design’ mortar, covered by BS EN 998-2 in 2010, became more widespread. Haseltine also stated in letters and reports:

“an M4 design mortar is the same as a 1 : 5-6 cement : sand mix.“

“an average batch volume proportion of 1:7.4 from which it is indicated that the mortar can be taken to agree with the designed mix and so there can be no complaint about it”

Yet in this case, of the 18 samples tested, by five different UKAS accredited testing laboratories, ranged from a best 1:7 to worst 1:9.6. In addition, the mix proportions from the manufacturer’s batch records fall well below the “guidance” mix table in NHBC Standards for M4 mortar, that would be deemed to meet Performance standard 6.1.14 and in turn, the NHBC mandatory Technical Requirements R2 and especially R3. When confronted by indisputable multiple evidence of insufficient cement.

Haseltine says:

“it was very common for laboratories not to reach the same results as others. Although I am not a chemist, I believe it is not possible to find more soluble silica, the basis for cement content, than is there but it is possible not to find all that is there.”

“A cement content of 8.5% equates to a volume mix of 1: 9.3; looking at all the test results in my table… I conclude that the mortar mix can be considered to be a designation (iv) on the basis of mix proportions, one must remember that this mortar was a designed M4 mix so mix proportions are not a valid means of checking compliance”

A designation (iv) being a mix ratio of 1:7, equivalent to M2. The cement : sand ratio of 1: 9.3 is even weaker than this and in any case is not the designed M4, designation (iii) required and specified!

“No samples were tested from mortar supplied to the site so there cannot be any allegation that the strength of the mortar that was supplied was incorrect. Factory Product Control (FCP) tests do not have to be related to any particular delivery of mortar”

“I would recommend M6 mortar for the repointing”

M6 is 1 : 3-4 cement : sand that is a minimum 25% cement content by volume. This for a new home constructed with mortar proven by laboratory testing, to have just 13% cement content.

Incorrect mortar specified at the design stage

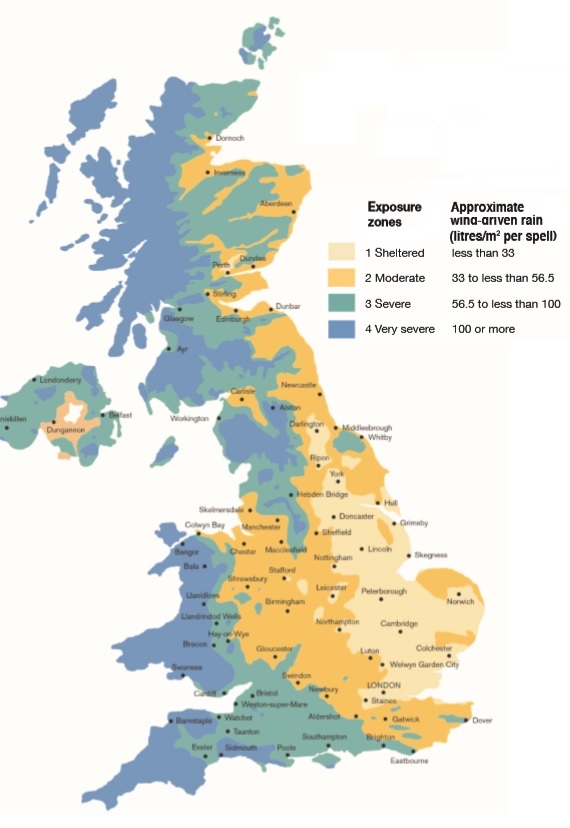

The mortar specified at the outset is often not as required by warranty standards for the level of exposure on certain developments. In geographical areas with ‘very severe’ and ‘severe’ exposure, new homes should be built using a mortar as designation (ii) – M6 which is an equivalent mix of 1:3 to 1:4 cement : sand. The Brick Development Association and Ibstock go further stating that in these areas, the cement used should be sulfate resisting cement (SRC). So mortar required to be M6 due to exposure, when M4 has been specified and used, clearly does not meet the NHBC mandatory technical requirements R2 or R3.

The mortar specified at the outset is often not as required by warranty standards for the level of exposure on certain developments. In geographical areas with ‘very severe’ and ‘severe’ exposure, new homes should be built using a mortar as designation (ii) – M6 which is an equivalent mix of 1:3 to 1:4 cement : sand. The Brick Development Association and Ibstock go further stating that in these areas, the cement used should be sulfate resisting cement (SRC). So mortar required to be M6 due to exposure, when M4 has been specified and used, clearly does not meet the NHBC mandatory technical requirements R2 or R3.

Insufficient cement

It is well known that the greater the cement content, the stronger the compressive strength of the mortar will be. It is relatively simple to take mortar samples from a wall and have them analysed in a laboratory. In most cases when buyers report crumbling mortar, these have proved the mortar has far less cement than is stated in NHBC warranty standards and in Table 2 found in the National Annex provided in BS EN 998-2:2010. In one case, laboratory analysis of samples found the mortar had just 36% of the cement (1:11) required in an area with severe exposure (1:4).

Testing weak mortar

There is no agreed UK or European Standard test method available for assessing the quality of questionable mortar, in-situ. However, when mortar samples have been taken and in one instance analysed by three accredited test houses they were found to contain far less cement (being in the range 1:7.5 to 1:10.5) than that required of a prescribed class (iii) mortar and has been classified as class range (iv) to (v). This casts doubt on the bond of wall ties that require a minimum of class (iv) mortar.

“Once mortar deteriorates it will compromise the

rest of the brickwork.” BDA

Wall Ties

A weak mix mortar as opposed to say a purely durability issue due to weathering, can have serious structural implications. (The NHBC tend to use the word “erosion” specifically excluded under the Buildmark warranty) In any mortar proved by laboratory analysis to be a mix with a cement content of less than 16% (1:6 – designation (iii) M4), the bond to the wall ties should be considered as inadequate, meaning the brickwork outer wall could potentially fall away from the house in severe stormy weather.

The NHBC’s go-to “mortar expert” concludes the request for testing using a screw pull-out test which records the helical wall tie pull-out force from a 20mm to 30mm depth, 6mm diameter hole within mortar, is “unwarranted”. He says “the results would be very dubious” due to vibration, concluding: “the wall ties are entirely adequate and no work is required to justify them.” but fails to grasp it is the integrity of the actual composite cavity wall that has been compromised by weak mortar, creating an inadequate bond with the wall ties, not the strength the actual wall ties. He appears to completely overlook that it is the performance of the overall structure in adverse weather conditions, especially in severe and very severe exposure areas, that has the potential of structural collapse and in the worst case, even loss of life. Furthermore an unconnected report by Tarmac regarding weak mortar in a Persimmon home stated “we are concerned about the fixity of the cavity ties into the outer leaf, which if not suitable will result in the cavity masonry wall mot acting as a composite structure when considering lateral wind loading. A 100mm thick brick single skin wall will be structurally inadequate when enduring high wind loading”

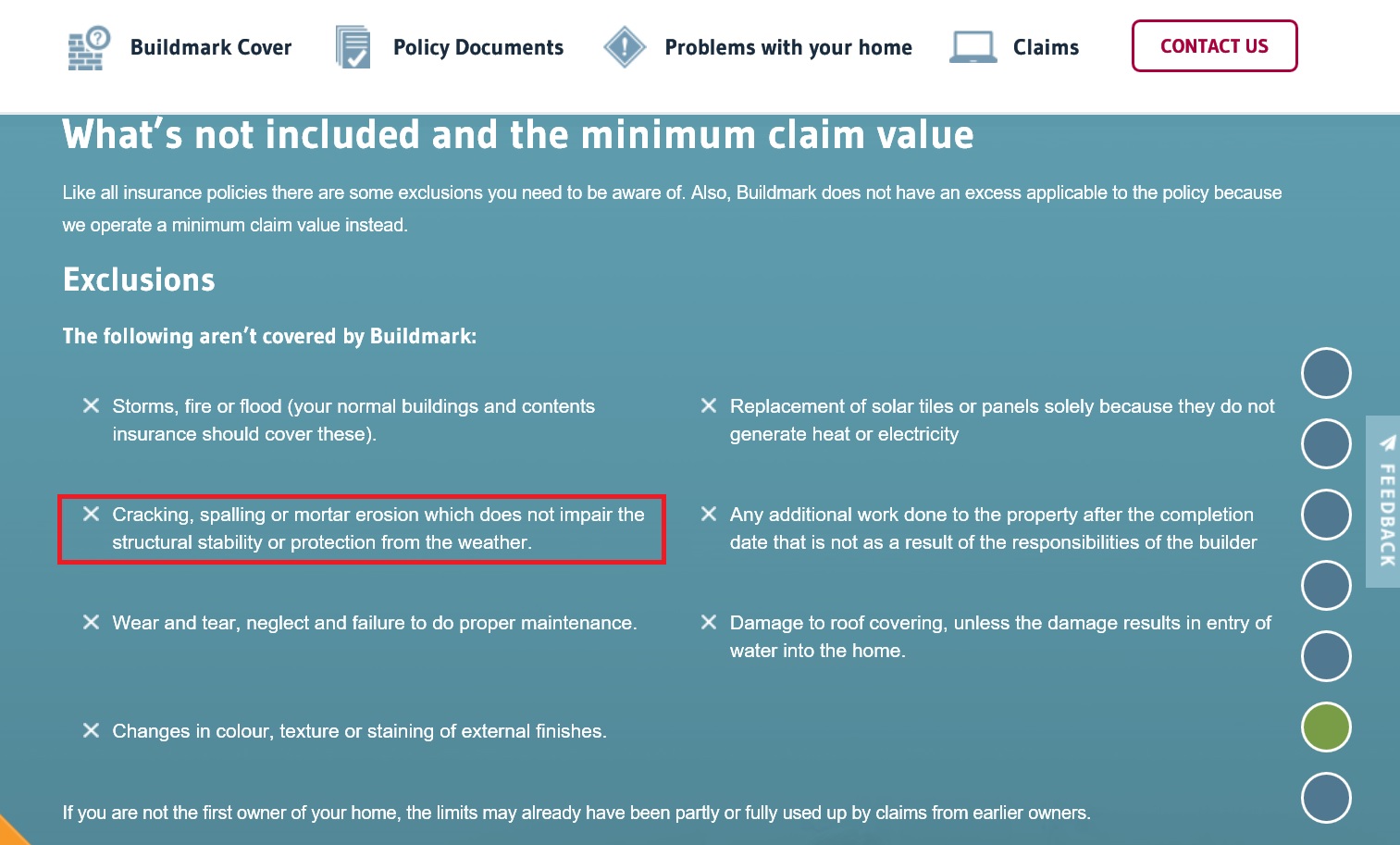

Erosion

The NHBC and their resident mortar expert make frequent use to the term “erosion” in letters to homeowners and reports. Could it be because erosion is not covered by the NHBC Buildmark warranty; “mortar erosion which does not impair the structural stability or protection from the weather” is specifically excluded. So in years 3 to 10, if the matter has not been addressed by the housebuilder, the NHBC can reject a claim and say it was caused by erosion.

Cement substitutes: Ground Granulated Blast furnace Slag (GGBS) and Pulverised Fuel Ash (PFA)

GGBS is a by-product from the production of iron. PFA is a by-product of burning pulverised coal in power stations. GGBS hydration mechanism is more complex and the rate of strength development is slower than that of Ordinary Portland Cement (OPC). Graham True of GFT Materials Consultancy says in his excellent article “What is happening to masonry mortar” that National Annex NA1 guidance based on best UK practice, including limitations on the use of replacing traditional OPC with GGBS or PFA ash, is restricted to specific levels namely 6–35%. One mortar supplier has stated that the National Annex guidance in BS EN 998-2 is just that – ‘guidance’ not ‘mandatory’ – and therefore can be ignored! Graham says: ”On investigation it transpires that GGBS additions are being incorporated at levels well above the recommended limits of 35%, up to 50% and more, of the total cementitious content.”

Even Barry Haseltine, the NHBC’s go-to 85-year old “mortar expert” acknowledged in at least one of his many reports that: “For the last 20 years or so, cement has become a complicated subject compared with the relative simplicity that existed when we had Ordinary Portland Cement and a small number of specialist mixtures for example masonry cement. It is a regrettable fact that mortar has become a potential problem with regard to durability in recent years, probably linked to the use of cements that have considerable proportions of additions which reduce the active cement in the mixes.”

Graham True says: “There has been, and probably will continue to be, issues related to the performance specification of mortar since it currently differs fundamentally from past UK practice but in addition so does the incorporation of high levels of cement replacements, in particular GGBS”

Sulfate attack

It is well known that where there is a high risk of saturation and in [very severe/severe] exposed areas, even with an M6 design mix, sulphate resisting cement should be used. Simply put, sulfate attack encompasses a series of chemical and physical interactions that occur between hardened cement paste and sulfates. The soluble sulfate salts within a high proportion of clay bricks react with a constituent (Tricalcium Aluminate) of the Ordinary Portland Cement within the mortar forming calcium Sulfoaluminate (Ettringite). So when sulfate present in bricks is dissolved due to driving rain and saturates brickwork in severe exposed areas, the sulphates present will cause mortar to degrade. For anyone interested in the chemistry.

Importantly for new homeowners with failing mortar, the normal 25mm rake out and repointing with M6 mortar will not have any lasting longevity if sulfates are present in the bricks. In investigations by Tarmac which supplied mortar to Persimmon site in Leeds found “sulfate levels higher than would be normally expected” believing that “the mortar has been subject to sulphate attack and cement degradation over a long period” However, it should be noted that it is in the mortar supplier’s own best interests to find alternative explanations to failing mortar other than incorrect mix proportions.

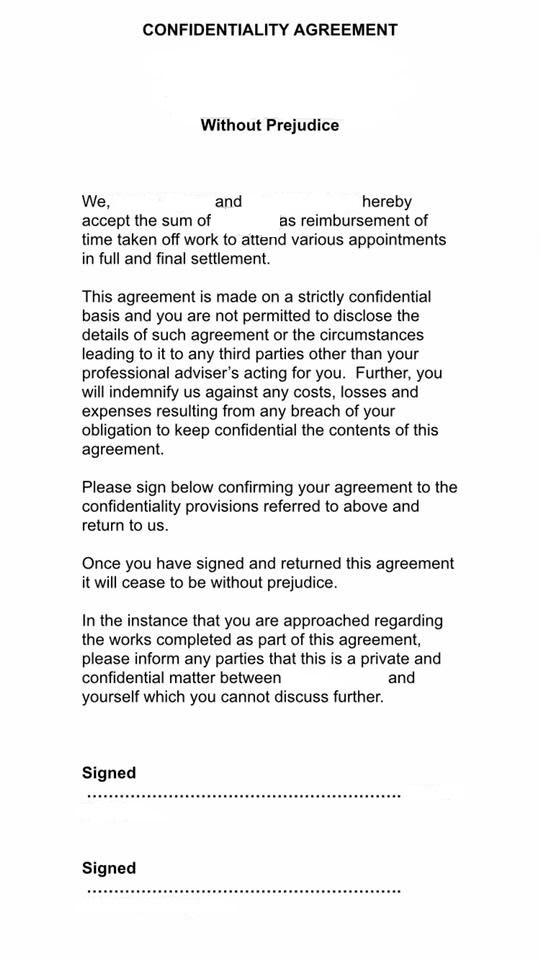

Use of Non Disclosure Agreements (NDAs)“Gagging orders”

Weak mortar is the housebuilding industry’s dirty secret and it is doing everything it can to ensure it is kept quiet. It has become almost standard operating procedure for housebuilders and warranty providers to require the homeowner to sign a legally-binding non-disclosure agreement (NDA) also referred to as a ‘gagging order’ as part of any compensation settlement, especially when buying the home in question. One buyer on a Taylor Wimpey estate in Peebles Scotland tells me: “over the course of the following few years, houses started to empty with folk just literally disappearing overnight – Taylor Wimpey were buying back houses, probably around 10-12 houses but it was still being kept hushed up.

People were signing gagging orders and therefore kept quiet. Taylor Wimpey sent out letters saying there were a few houses that had mortar issues and scaffolding was to be erected for repair works but not to be alarmed as they were isolated cases.”

People were signing gagging orders and therefore kept quiet. Taylor Wimpey sent out letters saying there were a few houses that had mortar issues and scaffolding was to be erected for repair works but not to be alarmed as they were isolated cases.”

I am also aware that the NHBC often require buyers to sign NDA’s perhaps because the last thing either housebuilders or the NHBC need is everyone on the development becoming aware of weak mortar issues in their home and making a similar claim. The Home Builders Federation chief Stewart Baseley said on BBC national radio –

“I’m a great believer in transparency” yet the industry he represents, promotes and defends, is anything but transparent.

New homebuyers with weak mortar tell me:

“The NHBC Resolution Service and recommendations are unregulated and totally outside the Financial Ombudsman’s jurisdiction making it open for abuse and for the NHBC to look after their direct customer, their housebuilder registered members. It seems all the NHBC need to do is actually offer their Resolution Service in the first two years but they then have an open book to recommend whatever they want as we all know.” (e mail)

“The NHBC Consumer Affairs Manager made claims which contradicted their own findings report and they also went on to say that my mortar tests were meaningless and that the Mortar M classification rating system is only a guidance, and that BS EN 1996-1-1 Eurocode 6 can be ignored.” (Social media)

Yet the NHBC standards clearly state that the builder must comply with “relevant standards” this includes BS EN 1996-1-1 Eurocode 6 states: 3.2.2 Specification of masonry mortar (1) Mortars should be classified by their compressive strength, expressed as the 1etter M followed by the compressive strength in N/n1m2, for example, M5. Prescribed masonry m0rtars, in addition to the M number, will be described by their prescribed constituents, e. g. 1: 1: 5 cement: lime: sand by volume.

NHBC have known about weak mortar issues for many years

NHBC Technical Newsletter July 2000 Issue 20

“The consequences of getting it wrong are well known to NHBC. At the least it may mean raking out all joints and repointing and at worst it can be removing the outer leaf and rebuilding. The problem is that too little cement is added to the mix to ensure that the strength is achieved and, perhaps more importantly, the hardened mortar is durable.”

“Take appropriate action to ensure that the right mortar mix is used. The consequences of not doing so are costly and can easily be avoided. NHBC inspection staff will be looking at mortar more closely and may take samples for analysis where they believe the mortar is not up to strength.”

So why have warranty standards not been revised to reduce the likelihood of failing mortar in new homes?

Why have cement replacement materials such as GGBS not been banned in masonry mortar? Especially as the reduced cement (OPC) is more vulnerable to attack from sulphates in bricks.

Why have the NHBC Standards not been revised to include BS EN 998-2 2010 for factory supplied “design mixes” and requiring testing of site mortar samples by housebuilders to ensure compliance?

Opinion

This industry must recognise the threat to UK homes posed by failing mortar. It must not be deliberately hidden, with homeowners that do reach agreement being legally silenced by NDAs. If Toyota can issue multiple recalls to around 7.43million car owners worldwide, surely the housebuilding industry has a duty to be open about weak mortar in new homes. This issue isn’t going away. Tens of thousands of new homes could, and in all probability do, have weak mortar. Many more are currently being built. As Jo Churchill MP for Bury St Edmonds said in the House of Commons debate on poor quality new homes:“…the repointing of joints on walls where purposeful demolition and reconstruction should have happened”

Nevertheless, “repointing to a depth of 25mm” is deemed by the NHBC as “the industry’s normal practise where repointing works are required” This, even when independent laboratory tests prove the cement content of factory-made design mix mortar is well below that required to achieve the durability, weatherproofing and structural performance required and when it is highly likely not to have “a life of 60 years” a definition of compliance with NHBC mandatory Technical Requirement R3

It is in my opinion inconceivable, that the NHBC’s “leading mortar expert” is not acting for and in the NHBC’s best interests, to limit the potential cost of weak mortar claims by understating and dismissing clear factual evidence of inadequate cement content in failing, independently tested, mortar samples. His repeated opinion and reliance is on the single fact that a ‘design mix’ need not meet the listed mix proportions solely on the basis that it is not a ‘prescribed mix’ and mix proportions cannot therefore be used to judge compliance with masonry codes and has no scientific basis of suitability or performance justification whatsoever.

The NHBC themselves do not cover themselves in glory either by making assumptions and dismissive statements in their letters to homeowners whose homes in some cases, are clearly and quite literally, disintegrating. Opinions are not fact. New homeowners that have homes built with mortar with insufficient cement content that is crumbling is an undisputable fact. The best they can hope repointing, without any investigations into the mortar bond strength with wall ties, the use of cement replacement such as GGBS or possible sulphate attack.

Unfortunately, this is an industry that runs roughshod over the interests of new homebuyers, fobbing them off with questionable expert opinions and interpretations, whilst hiding behind NDAs. Perhaps James Brokenshire’s recent announcement of statutory New Homes Ombudsman will force change.

Conclusion

Given the cost, disruption to homeowners and potential further reputational damage in this already tainted industry, you would expect that warranty providers would be updating their standards to reflect the now widespread use of factory produced mortar and covered by BS EN 998-2. If housebuilders persist in their apparent preference for design mix factory mortar, they must be required to take mortar samples during construction for their own independent testing, rather than relying on the manufacturer’s in-house test results.

Graham True told me: “I just do not know why the house builders can’t use the correct mortar. The cost difference is minimal. They should be made to use a Prescribed Mix since the Design Mixes fail.”

I totally agree.